Authors

Summary

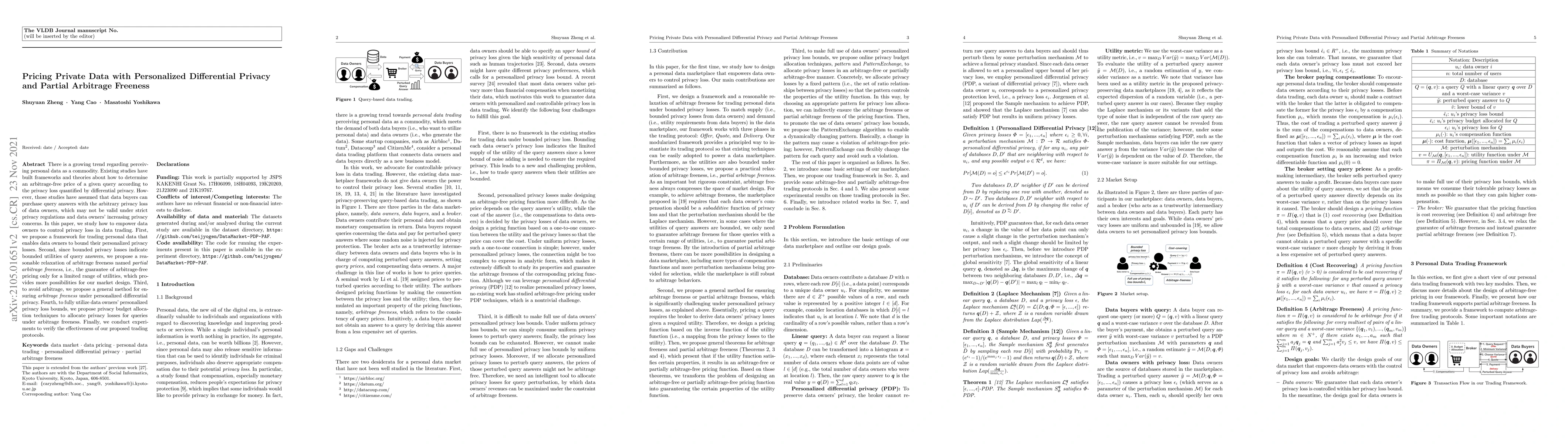

There is a growing trend regarding perceiving personal data as a commodity. Existing studies have built frameworks and theories about how to determine an arbitrage-free price of a given query according to the privacy loss quantified by differential privacy. However, those studies have assumed that data buyers can purchase query answers with the arbitrary privacy loss of data owners, which may not be valid under strict privacy regulations and data owners' increasing privacy concerns. In this paper, we study how to empower data owners to control privacy loss in data trading. First, we propose a framework for trading personal data that enables data owners to bound their personalized privacy losses. Second, since bounded privacy losses indicate bounded utilities of query answers, we propose a reasonable relaxation of arbitrage freeness named partial arbitrage freeness, i.e., the guarantee of arbitrage-free pricing only for a limited range of utilities, which provides more possibilities for our market design. Third, to avoid arbitrage, we propose a general method for ensuring arbitrage freeness under personalized differential privacy. Fourth, to fully utilize data owners' personalized privacy loss bounds, we propose privacy budget allocation techniques to allocate privacy losses for queries under arbitrage freeness. Finally, we conduct experiments to verify the effectiveness of our proposed trading protocols.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)