Summary

We develop a pricing model for Sovereign Contingent Convertible bonds (S-CoCo) with payment standstills triggered by a sovereign's Credit Default Swap (CDS) spread. We model CDS spread regime switching, which is prevalent during crises, as a hidden Markov process, coupled with a mean-reverting stochastic process of spread levels under fixed regimes, in order to obtain S-CoCo prices through simulation. The paper uses the pricing model in a Longstaff-Schwartz American option pricing framework to compute future state contingent S-CoCo prices for risk management. Dual trigger pricing is also discussed using the idiosyncratic CDS spread for the sovereign debt together with a broad market index. Numerical results are reported using S-CoCo designs for Greece, Italy and Germany with both the pricing and contingent pricing models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

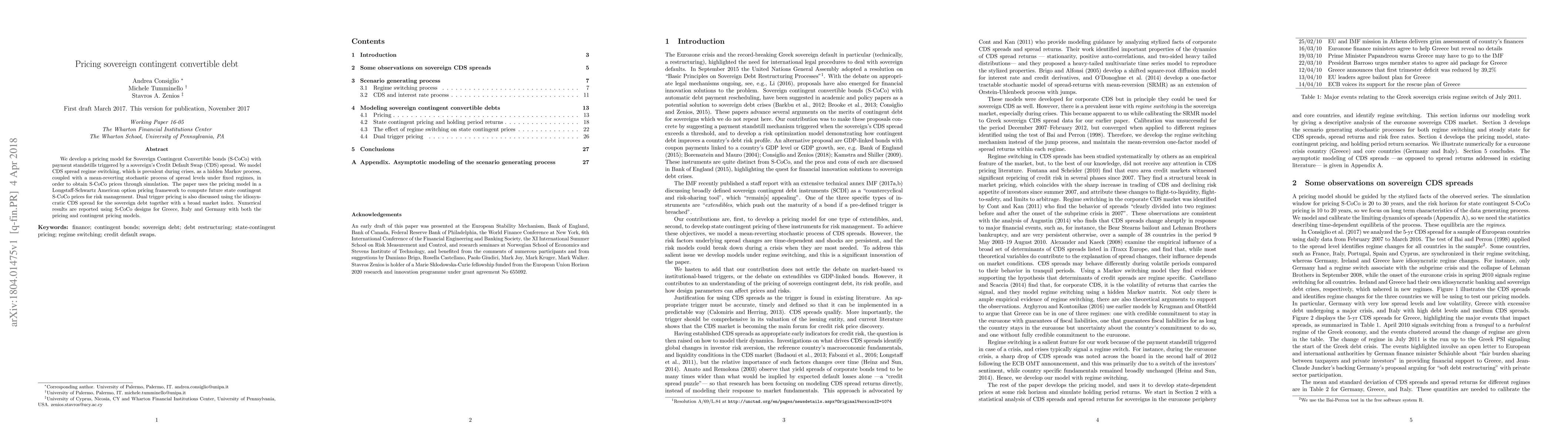

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersContingent Convertible Obligations and Financial Stability

Zachary Feinstein, T. R. Hurd

Sovereign Debt Default and Climate Risk

Emilio Barucci, Daniele Marazzina, Aldo Nassigh

Contingent Convertible Bonds in Financial Networks

Daniele Tantari, Giovanni Calice, Carlo Sala

| Title | Authors | Year | Actions |

|---|

Comments (0)