Summary

We analyze various jumps for Heston model, non-IID model and three L\'evy jump models for S&P 500 index options. The L\'evy jump for the S&P 500 index options is inevitable from empirical studies. We estimate parameters from in-sample pricing through SSE for the BS, SV, SVJ, non-IID and L\'evy (GH, NIG, CGMY) models by the method of Bakshi et al. (1997), and utilize them for out-of-sample pricing and compare these models. The sensitivities of the call option pricing for the L\'evy models with respect to parameters are presented. Empirically, we show that the NIG model, SV and SVJ models with estimated volatilities outperform other models for both in-sample and out-of-sample periods. Using the in-sample optimized parameters, we find that the NIG model has the least SSE and outperforms the rest models on one-day prediction.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

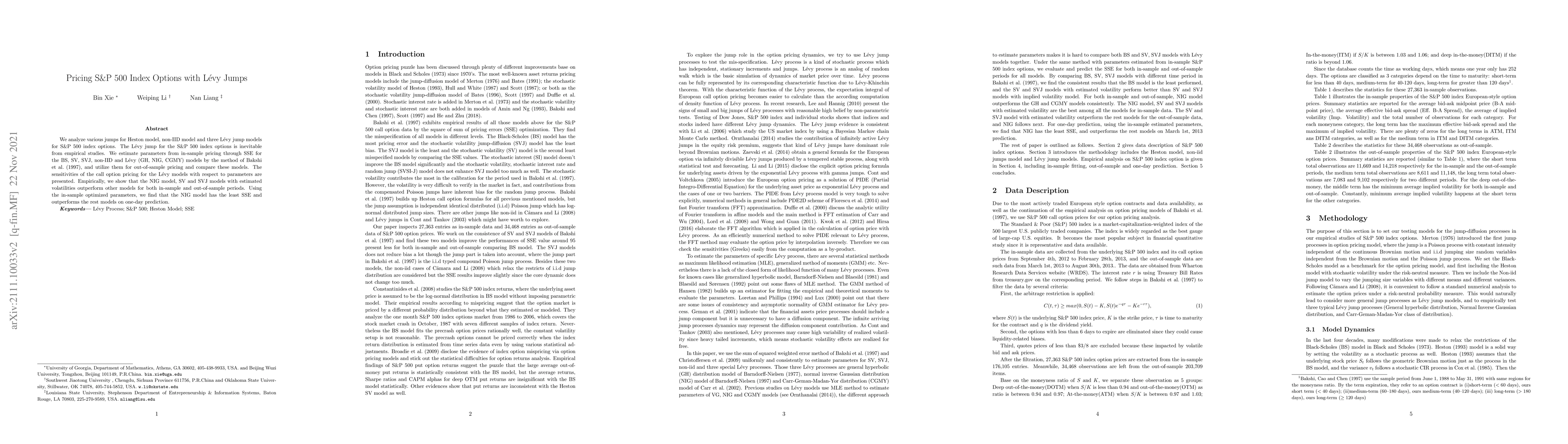

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)