Summary

In this paper, we relax the power parameter of instantaneous variance and develop a new stochastic volatility plus jumps model that generalize the Heston model and 3/2 model as special cases. This model has two distinctive features. First, we do not restrict the new parameter, letting the data speak as to its direction. The Generalized Methods of Moments suggests that the newly added parameter is to create varying volatility fluctuation in different period discovered in financial market. Moreover, upward and downward jumps are separately modeled to accommodate the market data. Our model is novel and highly tractable, which means that the quasi-closed-form solutions for future and option prices can be effectively derived. We have employed data on VIX future and corresponding option contracts to test this model to evaluate its ability of performing pricing and capturing features of the implied volatility. To sum up, the free stochastic volatility model with asymmetric jumps is able to adequately capture implied volatility dynamics and thus it can be seen as a superior model relative to the fixed volatility model in pricing VIX derivatives.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

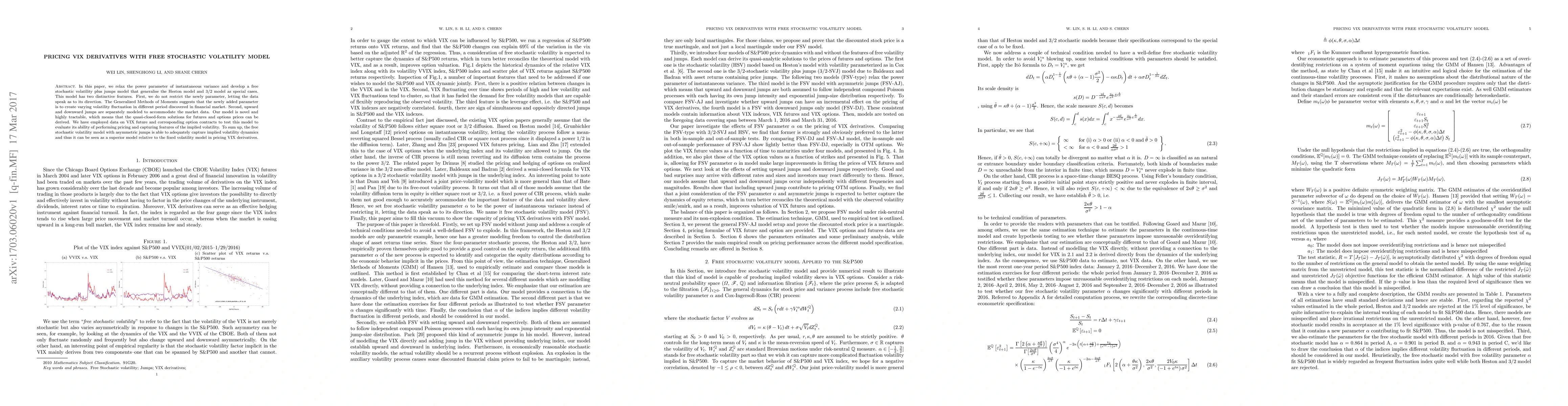

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)