Summary

This paper proposes a hybrid credit risk model, in closed form, to price vulnerable options with stochastic volatility. The distinctive features of the model are threefold. First, both the underlying and the option issuer's assets follow the Heston-Nandi GARCH model with their conditional variance being readily estimated and implemented solely on the basis of the observable prices in the market. Second, the model incorporates both idiosyncratic and systematic risks into the asset dynamics of the underlying and the option issuer, as well as the intensity process. Finally, the explicit pricing formula of vulnerable options enables us to undertake the comparative statistics analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

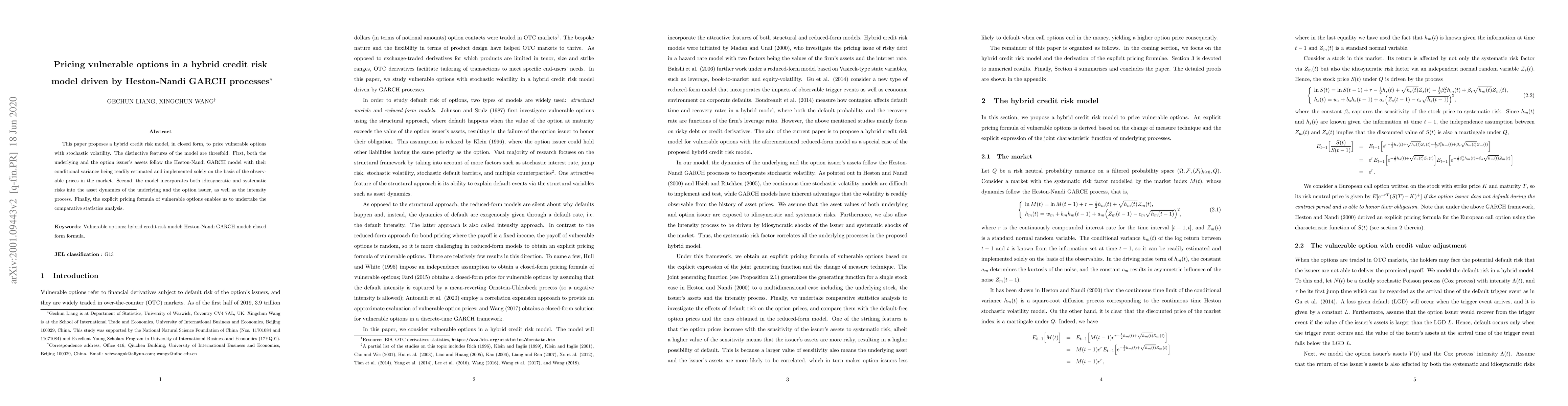

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPricing of geometric Asian options in the Volterra-Heston model

Florian Aichinger, Sascha Desmettre

Pricing VIX options under the Heston-Hawkes stochastic volatility model

Oriol Zamora Font

| Title | Authors | Year | Actions |

|---|

Comments (0)