Authors

Summary

This paper studies constrained optimal impulse control problems of a deterministic system described by a (semi)flow, where the performance measures are the discounted total costs including both the costs incurred with applying impulses as well as running costs. We formulate the relaxed problem and the associated primal convex programs in measures together with the dual programs, and establish the relevant duality results. As an application, we formulate and justify a general procedure for obtaining optimal $(J+1)$-mixed strategies for the original impulse control problems. This procedure is illustrated with a solved example.

AI Key Findings

Generated Jun 09, 2025

Methodology

The paper formulates and analyzes primal-dual programs for constrained optimal impulse control in a discounted model, establishing duality results and providing a procedure for obtaining optimal mixed strategies.

Key Results

- Establishment of primal and dual convex programs for the relaxed problem of constrained optimal impulse control.

- Formulation of a general procedure to obtain optimal (J+1)-mixed strategies for the original impulse control problems.

- Proof of equivalence between the primal-dual programs and the original impulse control problem under certain conditions.

- Identification of conditions under which the induced Markov decision process (MDP) is semicontinuous and satisfies the Slater condition.

Significance

This research contributes to the theoretical understanding of optimal impulse control problems, providing a framework for solving such problems using primal-dual methods, which has implications for control theory and operations research.

Technical Contribution

The paper develops primal-dual programs for constrained optimal impulse control, establishes duality results, and provides a method for deriving optimal mixed strategies, bridging the gap between relaxed and original impulse control problems.

Novelty

The approach combines primal-dual analysis with mixed strategies, offering a novel perspective on solving constrained optimal impulse control problems, particularly through the use of Lagrangian duality in the context of measure-valued solutions.

Limitations

- The paper focuses on deterministic systems described by (semi)flows and does not cover stochastic systems.

- The analysis is limited to the discounted total cost model; other cost structures are not explored.

Future Work

- Extension of the framework to stochastic systems and other cost models beyond the discounted total cost.

- Investigation of numerical methods for solving the primal-dual programs in practical scenarios.

Paper Details

PDF Preview

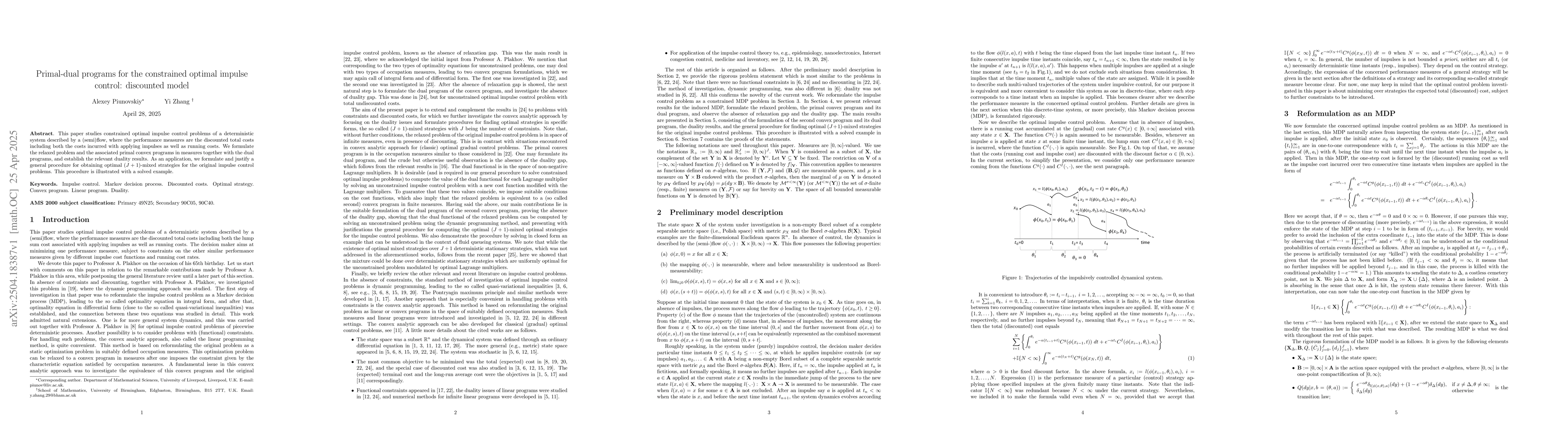

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA primal--dual algorithm as applied to optimal control problems

Regina S. Burachik, C. Yalçın Kaya, Xuemei Liu

Adaptive Primal-Dual Stochastic Gradient Method for Expectation-constrained Convex Stochastic Programs

Yangyang Xu, Yonggui Yan

Last-Iterate Convergent Policy Gradient Primal-Dual Methods for Constrained MDPs

Alejandro Ribeiro, Dongsheng Ding, Kaiqing Zhang et al.

No citations found for this paper.

Comments (0)