Summary

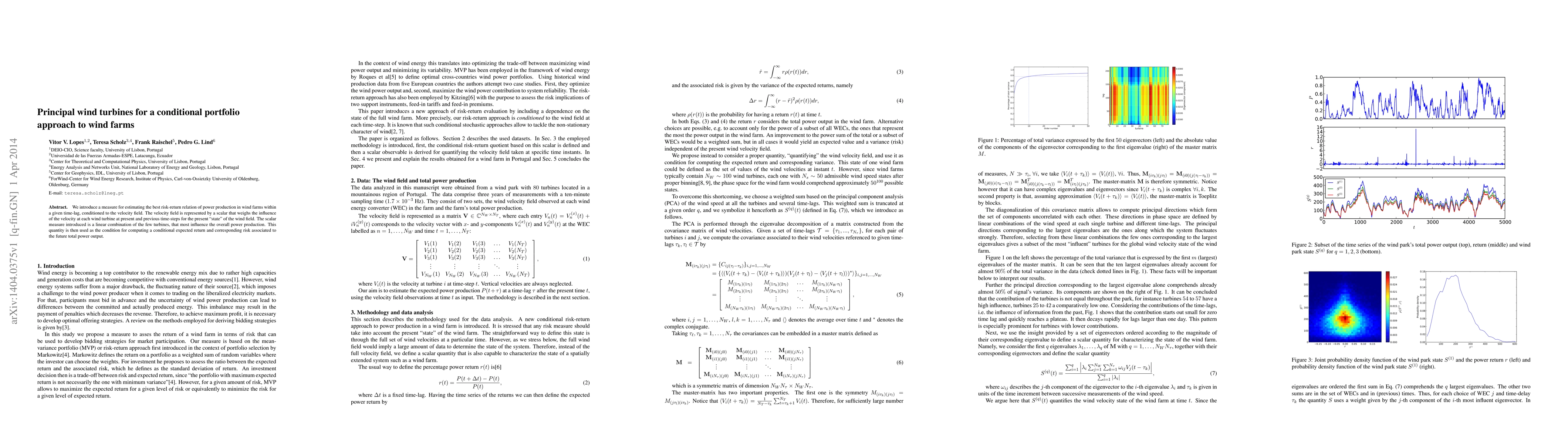

We introduce a measure for estimating the best risk-return relation of power production in wind farms within a given time-lag, conditioned to the velocity field. The velocity field is represented by a scalar that weighs the influence of the velocity at each wind turbine at present and previous time-steps for the present "state" of the wind field. The scalar measure introduced is a linear combination of the few turbines, that most influence the overall power production. This quantity is then used as the condition for computing a conditional expected return and corresponding risk associated to the future total power output.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDistributionally robust model predictive control for wind farms

Steven Liu, Christoph Mark

Learning to Optimise Wind Farms with Graph Transformers

Siyi Li, Matthew D. Piggott, A. Aldo Faisal et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)