Summary

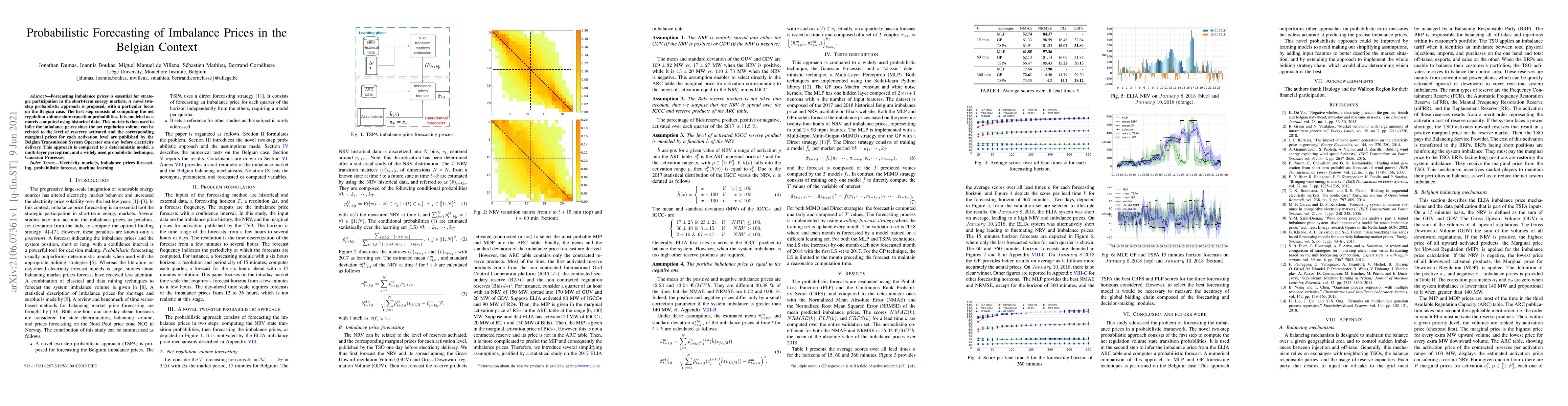

Forecasting imbalance prices is essential for strategic participation in the short-term energy markets. A novel two-step probabilistic approach is proposed, with a particular focus on the Belgian case. The first step consists of computing the net regulation volume state transition probabilities. It is modeled as a matrix computed using historical data. This matrix is then used to infer the imbalance prices since the net regulation volume can be related to the level of reserves activated and the corresponding marginal prices for each activation level are published by the Belgian Transmission System Operator one day before electricity delivery. This approach is compared to a deterministic model, a multi-layer perceptron, and a widely used probabilistic technique, Gaussian Processes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersProbabilistic forecasting of German electricity imbalance prices

Michał Narajewski

Probabilistic forecasting of power system imbalance using neural network-based ensembles

Bert Claessens, Chris Develder, Jonas Van Gompel

Adaptive probabilistic forecasting of French electricity spot prices

Grégoire Dutot, Margaux Zaffran, Olivier Féron et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)