Summary

In this paper we develop a framework for estimating Probability of Default (PD) based on stochastic models governing an appropriate asset value processes. In particular, we build upon a L\'evy-driven Ornstein-Uhlenbeck process and consider a generalized model that incorporates multiple latent variables affecting the evolution of the process. We obtain an Integral Equation (IE) formulation for the corresponding PD as a function of the initial position of the asset value process and the time until maturity, from which we then prove that the PD function satisfies an appropriate Partial Integro-Differential Equation (PIDE). These representations allow us to show that appropriate weak (viscosity) as well as strong solutions exist, and develop subsequent numerical schemes for the estimation of the PD function. Such a framework is necessary under the newly introduced International Financial Reporting Standards (IFRS) 9 regulation, which has imposed further requirements on the sophistication and rigor underlying credit modelling methodologies. We consider special cases of the generalized model that can be used for applications to credit risk modelling and provide examples specific to provisioning under IFRS 9, and more.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

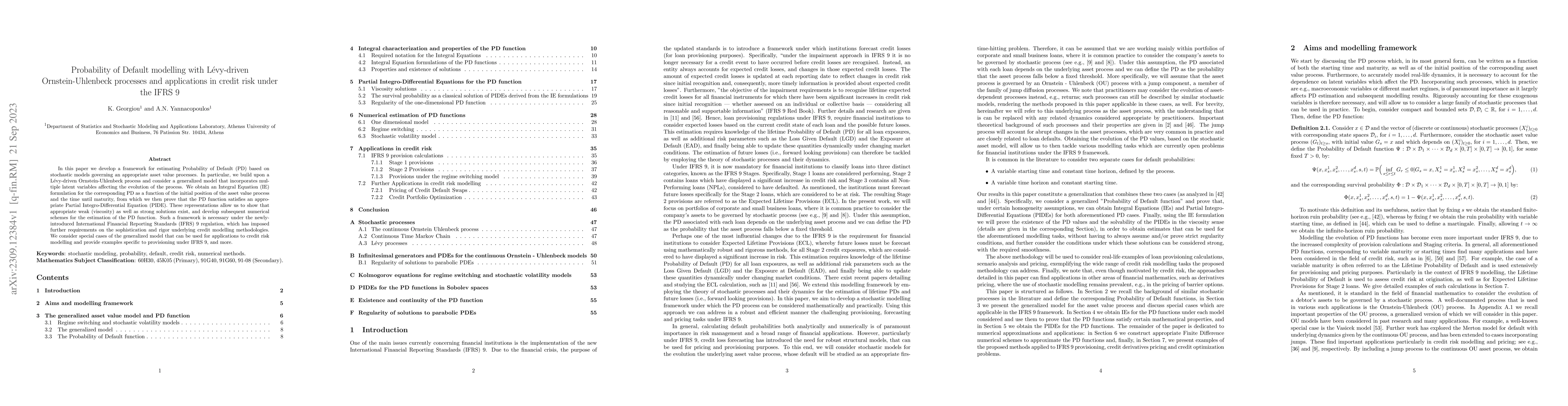

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn Lasso and Slope drift estimators for L\'evy-driven Ornstein--Uhlenbeck processes

Claudia Strauch, Niklas Dexheimer

No citations found for this paper.

Comments (0)