Summary

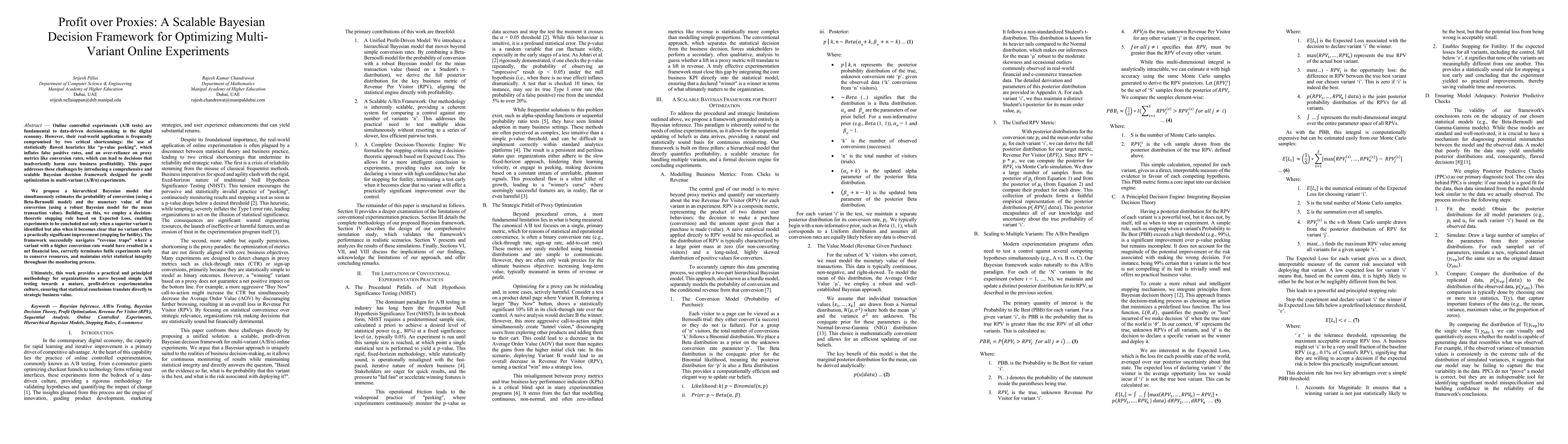

Online controlled experiments (A/B tests) are fundamental to data-driven decision-making in the digital economy. However, their real-world application is frequently compromised by two critical shortcomings: the use of statistically flawed heuristics like "p-value peeking", which inflates false positive rates, and an over-reliance on proxy metrics like conversion rates, which can lead to decisions that inadvertently harm core business profitability. This paper addresses these challenges by introducing a comprehensive and scalable Bayesian decision framework designed for profit optimization in multi-variant (A/B/n) experiments. We propose a hierarchical Bayesian model that simultaneously estimates the probability of conversion (using a Beta-Bernoulli model) and the monetary value of that conversion (using a robust Bayesian model for the mean transaction value). Building on this, we employ a decision-theoretic stopping rule based on Expected Loss, enabling experiments to be concluded not only when a superior variant is identified but also when it becomes clear that no variant offers a practically significant improvement (stopping for futility). The framework successfully navigates "revenue traps" where a variant with a higher conversion rate would have resulted in a net financial loss, correctly terminates futile experiments early to conserve resources, and maintains strict statistical integrity throughout the monitoring process. Ultimately, this work provides a practical and principled methodology for organizations to move beyond simple A/B testing towards a mature, profit-driven experimentation culture, ensuring that statistical conclusions translate directly to strategic business value.

AI Key Findings

Generated Oct 01, 2025

Methodology

The paper introduces a hierarchical Bayesian model that integrates conversion rate and monetary value estimation, combined with a decision-theoretic stopping rule based on Expected Loss to optimize multi-variant online experiments.

Key Results

- The Bayesian framework outperformed traditional proxy-based methods in identifying true winners and avoiding revenue traps by prioritizing profit over engagement metrics.

- It demonstrated significantly higher statistical power and reliability in multi-variant tests, with a 97.3% accuracy in detecting the true winner compared to 60.9% for the proxy method.

- The framework successfully implemented early stopping for futility, reducing test duration by 25% while avoiding false positives in scenarios with negligible business impact.

Significance

This research addresses critical flaws in conventional A/B testing by aligning statistical analysis with business objectives, enabling organizations to make data-driven decisions that directly impact profitability rather than relying on misleading proxy metrics.

Technical Contribution

A scalable Bayesian decision framework that simultaneously models conversion rates and monetary value using a hierarchical structure, combined with an Expected Loss stopping rule for profit-driven experimentation.

Novelty

The paper's novelty lies in its decision-theoretic approach that directly optimizes for business profit rather than proxy metrics, along with its ability to make intelligent early stopping decisions based on practical significance thresholds.

Limitations

- Assumes stationary conversion and revenue rates, without modeling temporal dynamics like novelty effects or seasonality.

- Focuses on a single primary business metric (RPV), lacking multi-objective optimization capabilities.

Future Work

- Integrate time-series priors to account for temporal dynamics and regime changes in user behavior.

- Extend the framework to support Bayesian multi-objective optimization for balancing competing business metrics.

Paper Details

PDF Preview

Similar Papers

Found 5 papersScalable Generalized Bayesian Online Neural Network Training for Sequential Decision Making

Kevin Murphy, Álvaro Cartea, Gerardo Duran-Martin et al.

Experimenting, Fast and Slow: Bayesian Optimization of Long-term Outcomes with Online Experiments

Benjamin Letham, Eytan Bakshy, Maximilian Balandat et al.

Beyond Profit: A Multi-Objective Framework for Electric Vehicle Charging Station Operations

Shuoyao Wang, Jiawei Lin

A Flexible Multi-Metric Bayesian Framework for Decision-Making in Phase II Multi-Arm Multi-Stage Studies

Suzanne M. Dufault, Angela M. Crook, Katie Rolfe et al.

Comments (0)