Summary

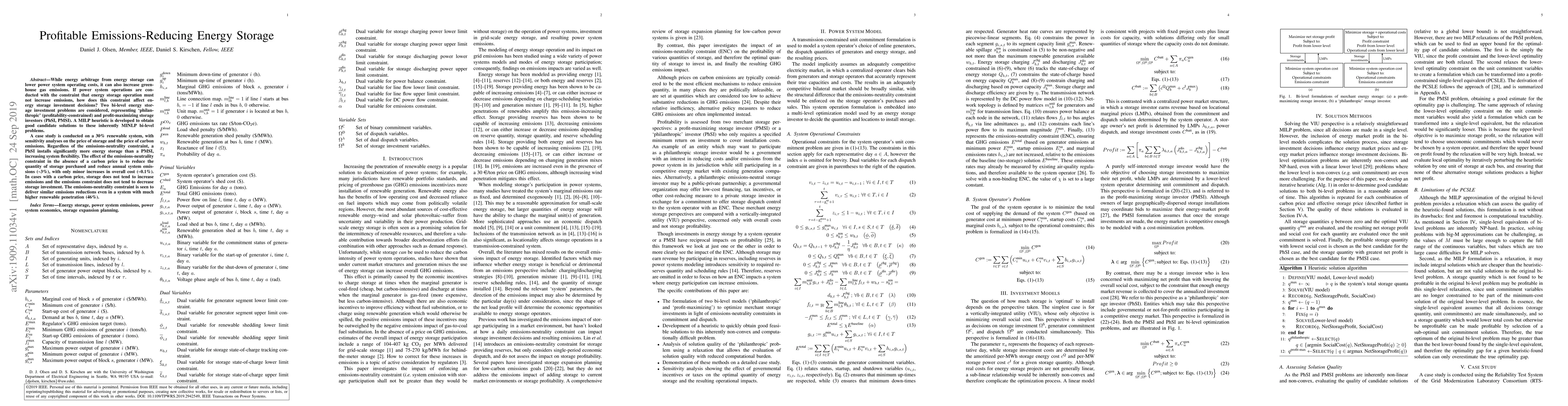

While energy arbitrage from energy storage can lower power system operating costs, it can also increase greenhouse gas emissions. If power system operations are conducted with the constraint that energy storage operation must not increase emissions, how does this constraint affect energy storage investment decisions? Two bi-level energy storage investment problems are considered, representing 'philanthropic' (profitability-constrained) and profit-maximizing storage investors (PhSI, PMSI). A MILP heuristic is developed to obtain good candidate solutions to these inherently MINLP bi-level problems. A case study is conducted on a 30% renewable system, with sensitivity analyses on the price of storage and the price of carbon emissions. Regardless of the emissions-neutrality constraint, a PhSI installs significantly more energy storage than a PMSI, increasing system flexibility. The effect of the emissions-neutrality constraint in the absence of a carbon price is to reduce the quantity of storage purchased and reduce annual system emissions (~3%), with only minor increases in overall cost (~0.1%). In cases with a carbon price, storage does not tend to increase emissions and the emissions constraint does not tend to decrease storage investment. The emissions-neutrality constraint is seen to deliver similar emissions reductions even in a system with much higher renewable penetration (46%).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersImpact Analysis of Utility-Scale Energy Storage on the ERCOT Grid in Reducing Renewable Generation Curtailments and Emissions

Caisheng Wang, Sharaf K. Magableh, Oraib Dawaghreh et al.

Reducing energy system model distortions from unintended storage cycling through variable costs

Martin Kittel, Daniel Friedrich, Maximilian Parzen et al.

The Impact of Grid Storage on Balancing Costs and Carbon Emissions in Great Britain

Phil Grunewald, Thomas Morstyn, Iacopo Savelli et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)