Summary

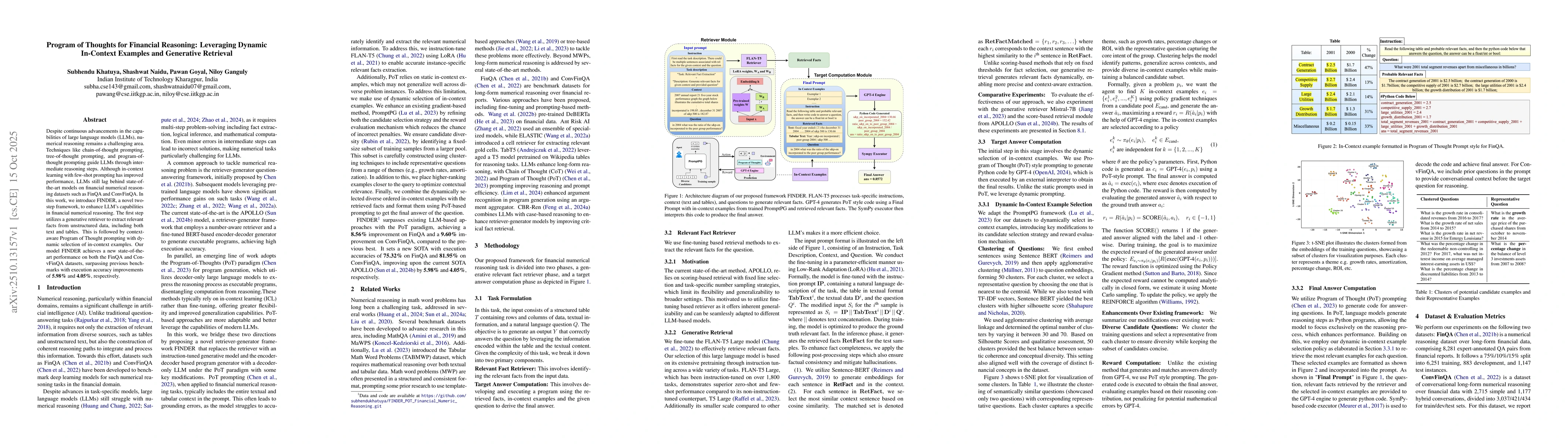

Despite continuous advancements in the capabilities of large language models (LLMs), numerical reasoning remains a challenging area. Techniques like chain-of-thought prompting, tree-of-thought prompting, and program-of-thought prompting guide LLMs through intermediate reasoning steps. Although in-context learning with few-shot prompting has improved performance, LLMs still lag behind state-of-the-art models on financial numerical reasoning datasets such as FinQA and ConvFinQA. In this work, we introduce FINDER, a novel two-step framework, to enhance LLMs' capabilities in financial numerical reasoning. The first step utilizes a generative retriever to extract relevant facts from unstructured data, including both text and tables. This is followed by context-aware Program of Thought prompting with dynamic selection of in-context examples. Our model FINDER achieves a new state-of-the-art performance on both the FinQA and ConvFinQA datasets, surpassing previous benchmarks with execution accuracy improvements of 5.98% and 4.05%, respectively.

AI Key Findings

Generated Oct 29, 2025

Methodology

The research introduces a hybrid approach combining case-based reasoning with fine-grained retrievers and ensemble generators for numerical reasoning in financial contexts. It employs iterative bootstrapping and reinforcement learning techniques to enhance reasoning processes.

Key Results

- FINDER achieves 74% execution accuracy on FinQA tasks

- APOLLO's optimized training approach improves long-form numerical reasoning

- The system outperforms previous methods in handling complex temporal questions

Significance

This work advances financial question answering systems by enabling more accurate and robust numerical reasoning, which has critical applications in finance, auditing, and data analysis.

Technical Contribution

Development of a case-based reasoning driven retriever-generator model with iterative bootstrapping for hybrid long-form numerical reasoning

Novelty

Integration of reinforcement learning with case-based reasoning for iterative refinement of numerical reasoning processes in financial contexts

Limitations

- Dependence on high-quality case bases

- Limited effectiveness with extremely complex or ambiguous financial instruments

Future Work

- Exploring multi-modal reasoning with additional data sources

- Enhancing reasoning capabilities for real-time financial market data

- Developing adaptive learning mechanisms for evolving financial regulations

Paper Details

PDF Preview

Similar Papers

Found 5 papersProgram of Thoughts Prompting: Disentangling Computation from Reasoning for Numerical Reasoning Tasks

Xinyi Wang, Wenhu Chen, Xueguang Ma et al.

RAT: Retrieval Augmented Thoughts Elicit Context-Aware Reasoning in Long-Horizon Generation

Zihao Wang, Jiaqi Li, Xiaojian Ma et al.

Retrieval Meets Reasoning: Dynamic In-Context Editing for Long-Text Understanding

Lei Deng, Wei Han, Weizhi Fei et al.

RARe: Retrieval Augmented Retrieval with In-Context Examples

Eunsol Choi, Sujay Sanghavi, Atula Tejaswi et al.

When Do Program-of-Thoughts Work for Reasoning?

Shumin Deng, Huajun Chen, Ningyu Zhang et al.

Comments (0)