Summary

Many pharmaceutical companies face concerns with the maintenance of desired revenue levels. Sales forecasts for the current portfolio of products and projects may indicate a decline in revenue as the marketed products approach patent expiry. To counteract the potential downturn in revenue, and to establish revenue growth, an in-flow of new projects into the development phases is required. In this article, we devise an approach with which the in-flow of new projects could be optimized, while adhering to the objectives and constraints set on revenue targets, budget limitations and strategic considerations on the composition of the company's portfolio.

AI Key Findings

Generated Jun 11, 2025

Methodology

The research employs a simulated annealing algorithm for combinatorial optimization to devise an approach for optimizing the inflow of new projects in the pharmaceutical industry's development portfolio, considering strategic objectives and constraints such as revenue targets, budget limitations, and portfolio composition.

Key Results

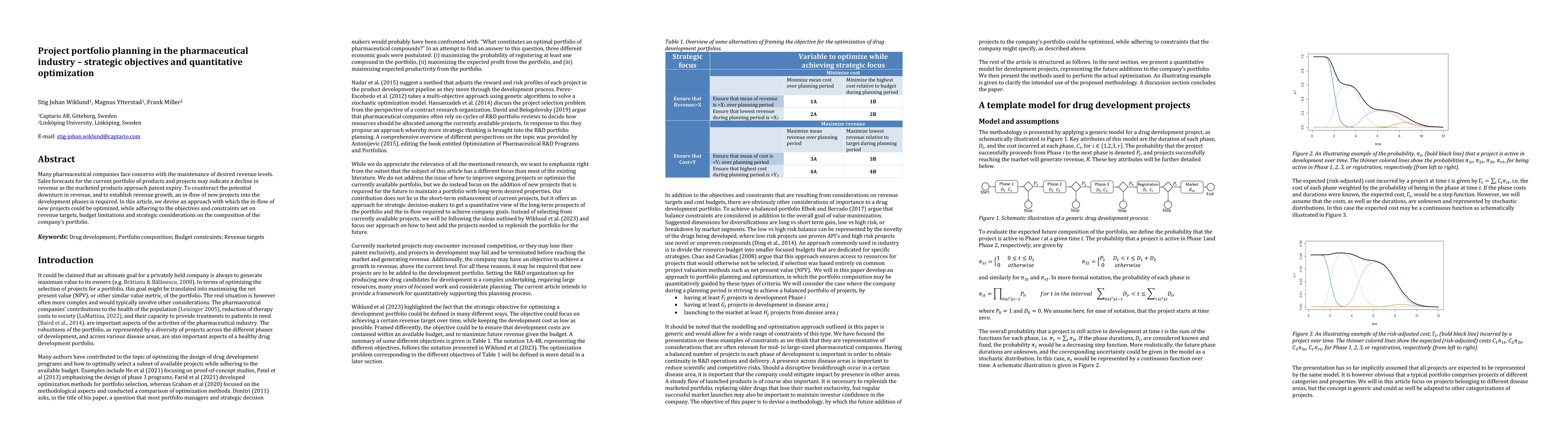

- The study presents eight different ways of framing strategic goals, leading to various optimization problems (1A-4B) with distinct objective functions.

- Strategic goal 2B effectively achieves target revenue each year while keeping costs within budget for most of the period.

- Strategic goal 3B maintains costs within budget while moderately exceeding it in substantial parts of the planning period to minimize revenue deficits.

- Strategic goal 4B focuses on new projects primarily from disease area 2 to keep costs within budget and minimize revenue deficits, though the revenue target isn't fully met.

- The model incorporates constraints to ensure a balanced and diverse development portfolio with active projects in all phases and across disease areas, along with a healthy level of market launches.

Significance

This research is important as it shifts the focus from traditional project selection to addressing the inflow of new projects, providing a dynamic framework for long-term strategic decision-making in the pharmaceutical industry, which is crucial due to the protracted timelines and high risk of failure in drug development.

Technical Contribution

The main technical contribution lies in the development of a multi-objective optimization framework for project portfolio planning in the pharmaceutical industry, which considers both strategic goals and constraints over a long-term planning horizon.

Novelty

This work is novel as it focuses on optimizing the inflow of new projects rather than solely on existing ones, providing a more dynamic and strategic framework aligned with the long-term nature of drug development, and utilizing multiple objective functions to offer a more nuanced understanding of project portfolio optimization.

Limitations

- The model simplifies project characteristics using expected values, which may not fully capture the variability and uncertainty of real projects.

- The study does not account for the impact of external factors like regulatory changes, market dynamics, or competitive landscape on project success and portfolio performance.

Future Work

- Incorporate stochastic elements and varying project characteristics to better represent the real-world variability and uncertainty of drug development projects.

- Explore the integration of business development and alliances to allow projects to enter the pipeline at any development phase, enhancing the model's realism and flexibility.

Paper Details

PDF Preview

Similar Papers

Found 4 papersAwareness and use of quantitative decision-making methods in pharmaceutical development

Martin Oliver Sailer, Juan J. Abellan, Nicolas Bonnet et al.

A Semantic-driven Approach for Maintenance Digitalization in the Pharmaceutical Industry

Xiaochen Zheng, Ju Wu, Marco Madlena et al.

No citations found for this paper.

Comments (0)