Summary

Quantum computers are expected to have substantial impact on the finance industry, as they will be able to solve certain problems considerably faster than the best known classical algorithms. In this article we describe such potential applications of quantum computing to finance, starting with the state-of-the-art and focusing in particular on recent works by the QC Ware team. We consider quantum speedups for Monte Carlo methods, portfolio optimization, and machine learning. For each application we describe the extent of quantum speedup possible and estimate the quantum resources required to achieve a practical speedup. The near-term relevance of these quantum finance algorithms varies widely across applications - some of them are heuristic algorithms designed to be amenable to near-term prototype quantum computers, while others are proven speedups which require larger-scale quantum computers to implement. We also describe powerful ways to bring these speedups closer to experimental feasibility - in particular describing lower depth algorithms for Monte Carlo methods and quantum machine learning, as well as quantum annealing heuristics for portfolio optimization. This article is targeted at financial professionals and no particular background in quantum computation is assumed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

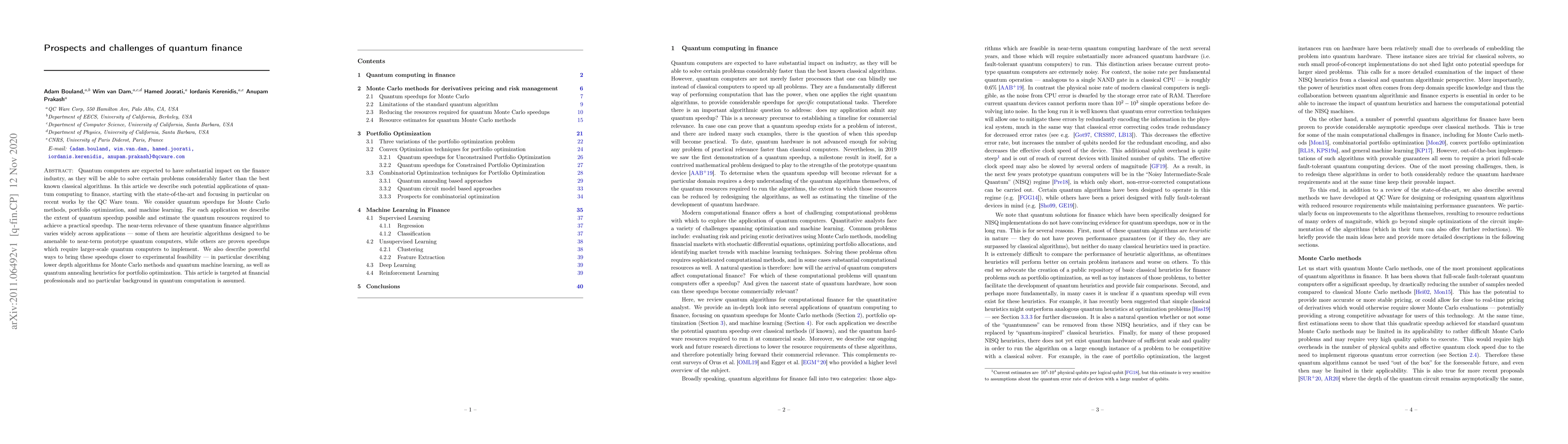

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOpportunities and Challenges of Generative-AI in Finance

Akshar Prabhu Desai, Tejasvi Ravi, Mohammad Luqman et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)