Summary

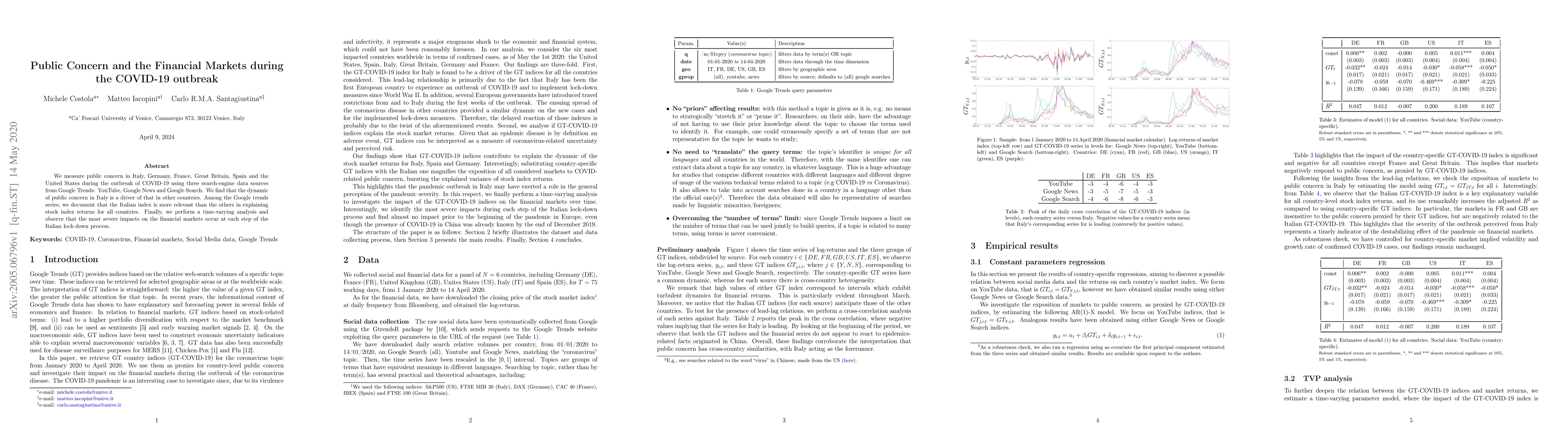

We measure the public concern during the outbreak of COVID-19 disease using three data sources from Google Trends (YouTube, Google News, and Google Search). Our findings are three-fold. First, the public concern in Italy is found to be a driver of the concerns in other countries. Second, we document that Google Trends data for Italy better explains the stock index returns of France, Germany, Great Britain, the United States, and Spain with respect to their country-based indicators. Finally, we perform a time-varying analysis and identify that the most severe impacts in the financial markets occur at each step of the Italian lock-down process.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)