Authors

Summary

We study an online generalization of the classic Joint Replenishment Problem (JRP) that models the trade-off between ordering costs, holding costs, and backlog costs in supply chain planning systems. A retailer places orders to a supplier for multiple items over time: each request is for some item that the retailer needs in the future, and has an arrival time and a soft deadline. If a request is served before its deadline, the retailer pays a holding cost per unit of the item until the deadline. However, if a request is served after its deadline, the retailer pays a backlog cost per unit. Each service incurs a fixed joint service cost and a fixed item-dependent cost for every item included in a service. These fixed costs are the same irrespective of the units of each item ordered. The goal is to schedule services to satisfy all the online requests while minimizing the sum of the service costs, the holding costs, and the backlog costs. Constant competitive online algorithms have been developed for two special cases: the make-to-order version when the deadlines are equal to arrival times (Buchbinder et al., 2013), and the make-to-stock version with hard deadlines with zero holding costs (Bienkowski et al., 2014). Our general model with holding and backlog costs has not been investigated earlier, and no online algorithms are known even in the make-to-stock version with hard deadlines and non-zero holding costs. We develop a new online algorithm for the general version of online JRP with both holding and backlog costs and establish that it is 30-competitive. Along the way, we develop a 3-competitive algorithm for the single-item case that we build on to get our final result. Our algorithm uses a greedy strategy and its competitiveness is shown using a dual fitting analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

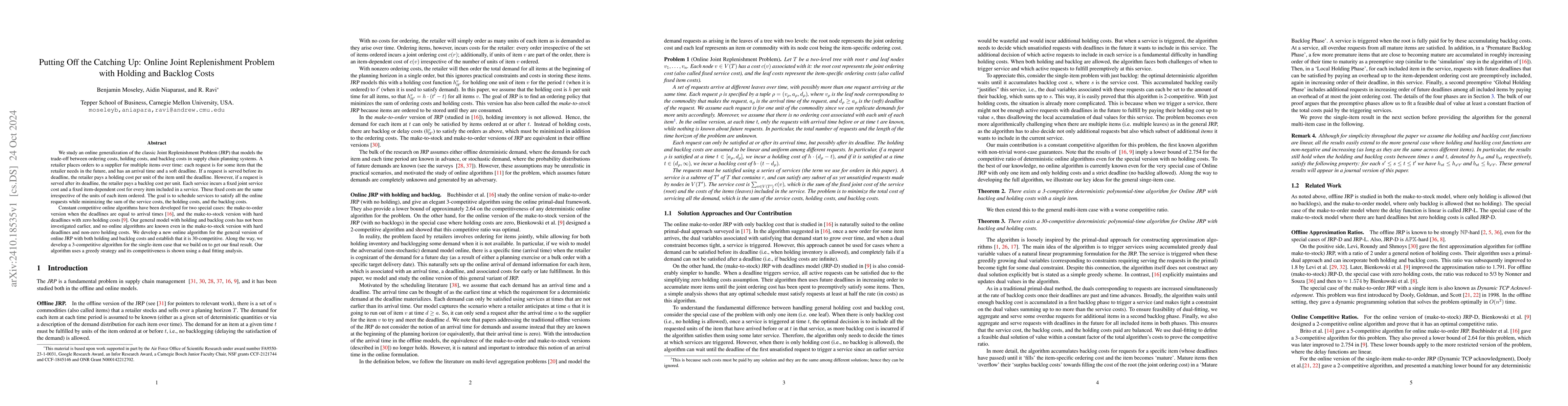

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOnline Joint Replenishment Problem with Arbitrary Holding and Backlog Costs

Yossi Azar, Shahar Lewkowicz

An online joint replenishment problem combined with single machine scheduling

Tamás Kis, Péter Györgyi, Tímea Tamási

No citations found for this paper.

Comments (0)