Authors

Summary

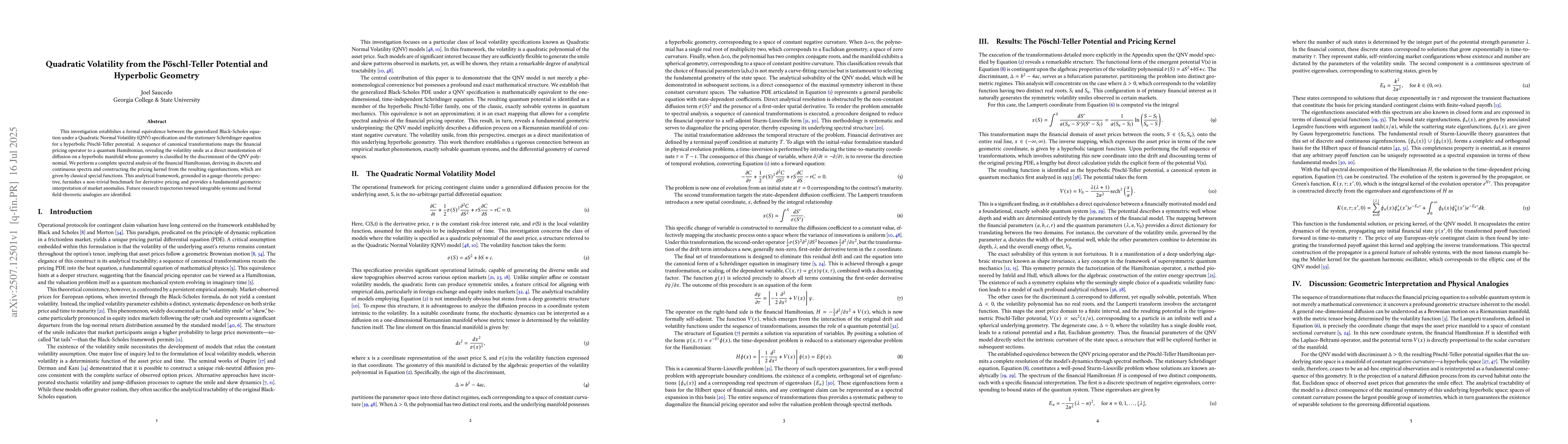

This investigation establishes a formal equivalence between the generalized Black-Scholes equation under a Quadratic Normal Volatility (QNV) specification and the stationary Schr\"odinger equation for a hyperbolic P\"oschl-Teller potential. A sequence of canonical transformations maps the financial pricing operator to a quantum Hamiltonian, revealing the volatility smile as a direct manifestation of diffusion on a hyperbolic manifold whose geometry is classified by the discriminant of the QNV polynomial. We perform a complete spectral analysis of the financial Hamiltonian, deriving its discrete and continuous spectra and constructing the pricing kernel from the resulting eigenfunctions, which are given by classical special functions. This analytical framework, grounded in a gauge-theoretic perspective, furnishes a non-trivial benchmark for derivative pricing and provides a fundamental geometric interpretation of market anomalies. Future research trajectories toward integrable systems and formal field-theoretic analogies are identified.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe exotic structure of the spectral $ζ$-function for the Schrödinger operator with Pöschl--Teller potential

Guglielmo Fucci, Jonathan Stanfill

Collective Excitation of Quantum Droplet with Different Ranges of the Interaction of Pöschl-Teller Potential

Avra Banerjee, Dwipesh Majumder

No citations found for this paper.

Comments (0)