Summary

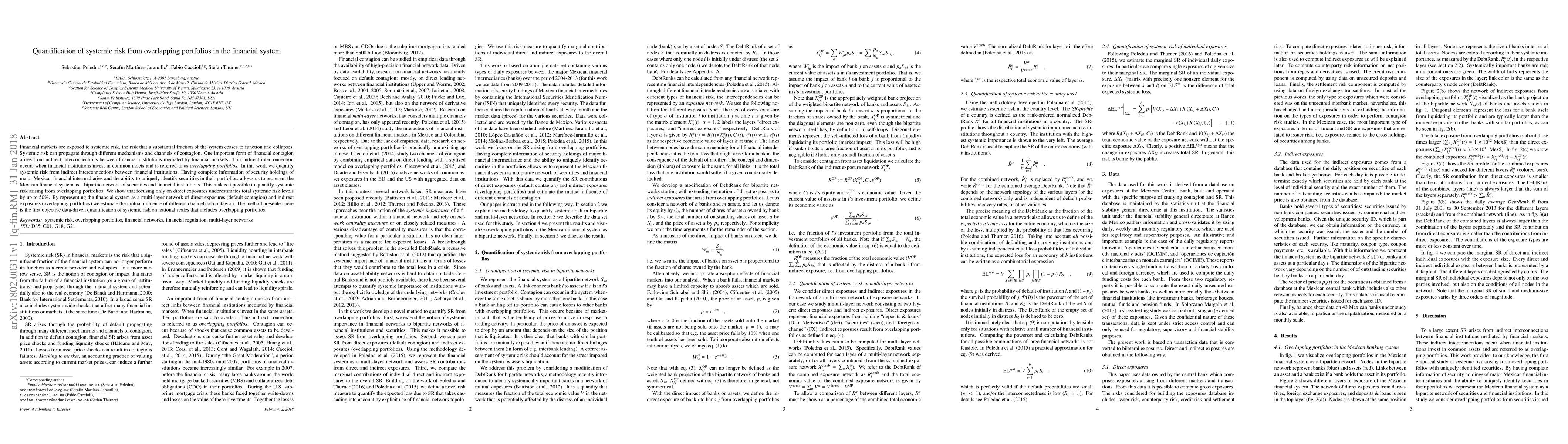

Financial markets are exposed to systemic risk, the risk that a substantial fraction of the system ceases to function and collapses. Systemic risk can propagate through different mechanisms and channels of contagion. One important form of financial contagion arises from indirect interconnections between financial institutions mediated by financial markets. This indirect interconnection occurs when financial institutions invest in common assets and is referred to as overlapping portfolios. In this work we quantify systemic risk from indirect interconnections between financial institutions. Having complete information of security holdings of major Mexican financial intermediaries and the ability to uniquely identify securities in their portfolios, allows us to represent the Mexican financial system as a bipartite network of securities and financial institutions. This makes it possible to quantify systemic risk arising from overlapping portfolios. We show that focusing only on direct exposures underestimates total systemic risk levels by up to 50%. By representing the financial system as a multi-layer network of direct exposures (default contagion) and indirect exposures (overlapping portfolios) we estimate the mutual influence of different channels of contagion. The method presented here is the first objective data-driven quantification of systemic risk on national scales that includes overlapping portfolios.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)