Summary

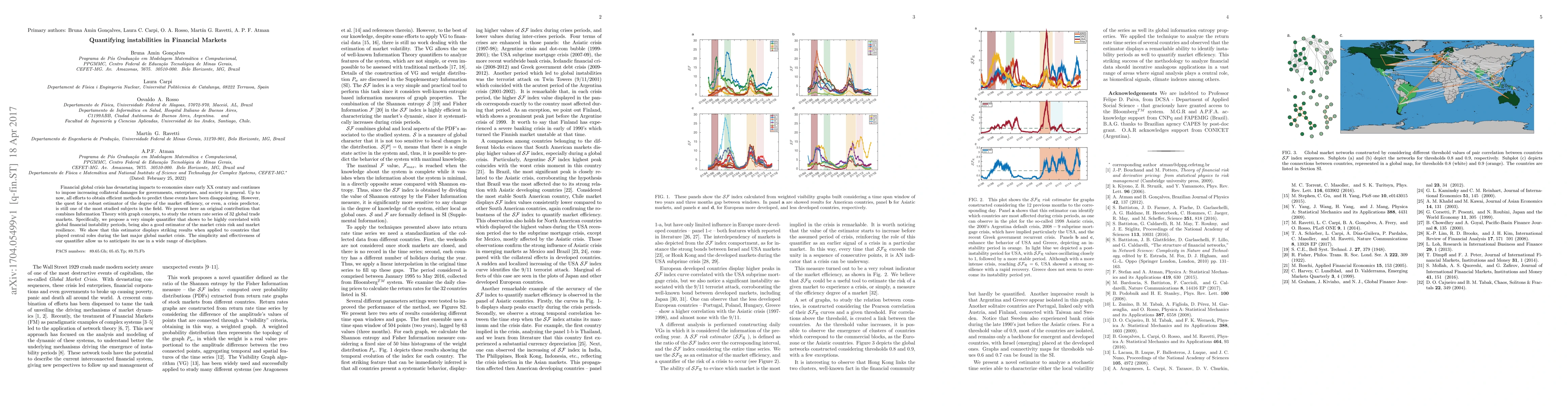

Financial global crisis has devastating impacts to economies since early XX century and continues to impose increasing collateral damages for governments, enterprises, and society in general. Up to now, all efforts to obtain efficient methods to predict these events have been disappointing. However, the quest for a robust estimator of the degree of the market efficiency, or even, a crisis predictor, is still one of the most studied subjects in the field. We present here an original contribution that combines Information Theory with graph concepts, to study the return rate series of 32 global trade markets. Specifically, we propose a very simple quantifier that shows to be highly correlated with global financial instability periods, being also a good estimator of the market crisis risk and market resilience. We show that this estimator displays striking results when applied to countries that played central roles during the last major global market crisis. The simplicity and effectiveness of our quantifier allow us to anticipate its use in a wide range of disciplines.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMultifractal analysis of financial markets

Wei-Xing Zhou, Wen-Jie Xie, Didier Sornette et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)