Summary

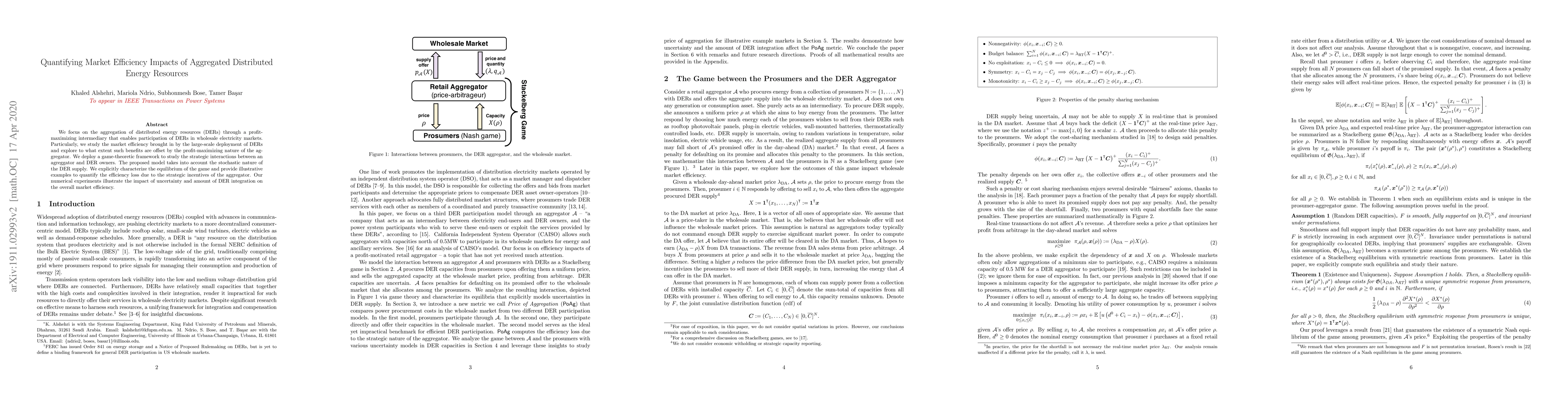

We focus on the aggregation of distributed energy resources (DERs) through a profit-maximizing intermediary that enables participation of DERs in wholesale electricity markets. Particularly, we study the market efficiency brought in by the large-scale deployment of DERs and explore to what extent such benefits are offset by the profit-maximizing nature of the aggregator. We deploy a game-theoretic framework to study the strategic interactions between an aggregator and DER owners. The proposed model takes into account the stochastic nature of the DER supply. We explicitly characterize the equilibrium of the game and provide illustrative examples to quantify the efficiency loss due to the strategic incentives of the aggregator. Our numerical experiments illustrate the impact of uncertainty and amount of DER integration on the overall market efficiency.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Connection Phase Selection of Residential Distributed Energy Resources and its Impact on Aggregated Demand

Damien Ernst, Amina Benzerga, Alireza Bahmanyar

Quantification of Market Power Mitigation via Efficient Aggregation of Distributed Energy Resources

Khaled Alshehri, John R. Birge, Zuguang Gao

| Title | Authors | Year | Actions |

|---|

Comments (0)