Summary

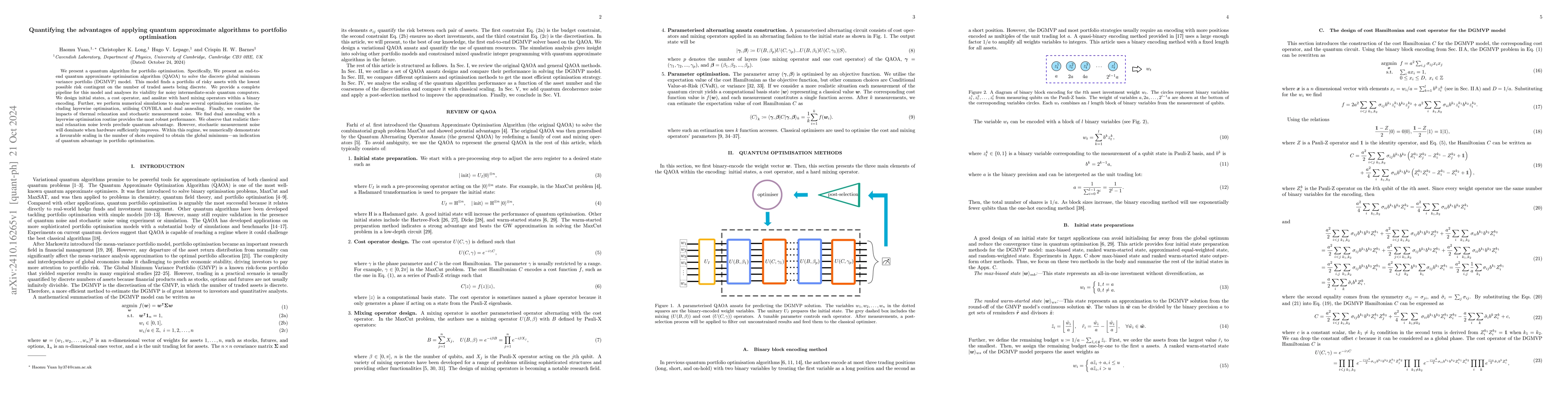

We present a quantum algorithm for portfolio optimisation. Specifically, We present an end-to-end quantum approximate optimisation algorithm (QAOA) to solve the discrete global minimum variance portfolio (DGMVP) model. This model finds a portfolio of risky assets with the lowest possible risk contingent on the number of traded assets being discrete. We provide a complete pipeline for this model and analyses its viability for noisy intermediate-scale quantum computers. We design initial states, a cost operator, and ans\"atze with hard mixing operators within a binary encoding. Further, we perform numerical simulations to analyse several optimisation routines, including layerwise optimisation, utilising COYBLA and dual annealing. Finally, we consider the impacts of thermal relaxation and stochastic measurement noise. We find dual annealing with a layerwise optimisation routine provides the most robust performance. We observe that realistic thermal relaxation noise levels preclude quantum advantage. However, stochastic measurement noise will dominate when hardware sufficiently improves. Within this regime, we numerically demonstrate a favourable scaling in the number of shots required to obtain the global minimum -- an indication of quantum advantage in portfolio optimisation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA quantum unstructured search algorithm for discrete optimisation: the use case of portfolio optimisation

Titos Matsakos, Adrian Lomas

Quantum Approximate Optimisation Applied to Graph Similarity

Nicholas J. Pritchard

No citations found for this paper.

Comments (0)