Authors

Summary

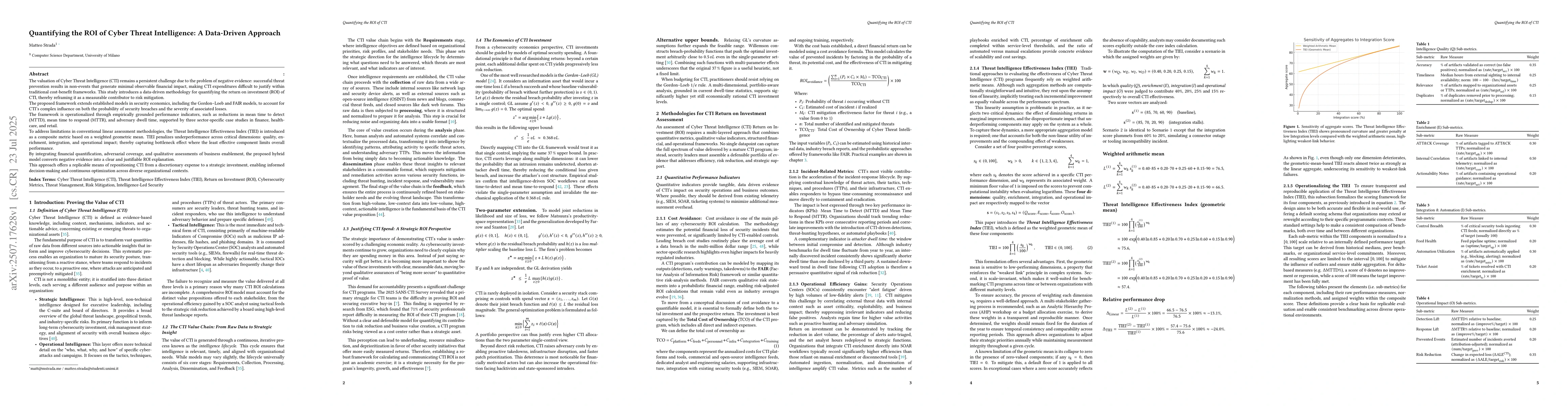

The valuation of Cyber Threat Intelligence (CTI) remains a persistent challenge due to the problem of negative evidence: successful threat prevention results in non-events that generate minimal observable financial impact, making CTI expenditures difficult to justify within traditional cost-benefit frameworks. This study introduces a data-driven methodology for quantifying the return on investment (ROI) of CTI, thereby reframing it as a measurable contributor to risk mitigation. The proposed framework extends established models in security economics, including the Gordon-Loeb and FAIR models, to account for CTI's complex influence on both the probability of security breaches and the severity of associated losses. The framework is operationalized through empirically grounded performance indicators, such as reductions in mean time to detect (MTTD), mean time to respond (MTTR), and adversary dwell time, supported by three sector-specific case studies in finance, healthcare, and retail. To address limitations in conventional linear assessment methodologies, the Threat Intelligence Effectiveness Index (TIEI) is introduced as a composite metric based on a weighted geometric mean. TIEI penalizes underperformance across critical dimensions: quality, enrichment, integration, and operational impact; thereby capturing bottleneck effect where the least effective component limits overall performance. By integrating financial quantification, adversarial coverage, and qualitative assessments of business enablement, the proposed hybrid model converts negative evidence into a justifiable ROI explanation. This approach offers a replicable means of repositioning CTI from an expense to a strategic investment, enabling informed decision-making and continuous optimization across diverse organizational contexts.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAI-Driven Cyber Threat Intelligence Automation

Fatemeh Khoda Parast, Shrit Shah

A Threat Intelligence Event Extraction Conceptual Model for Cyber Threat Intelligence Feeds

Jamal H. Al-Yasiri, Mohamad Fadli Bin Zolkipli, Nik Fatinah N Mohd Farid et al.

No citations found for this paper.

Comments (0)