Summary

We develop a novel approach for the construction of quantile processes governing the stochastic dynamics of quantiles in continuous time. Two classes of quantile diffusions are identified: the first, which we largely focus on, features a dynamic random quantile level and allows for direct interpretation of the resulting quantile process characteristics such as location, scale, skewness and kurtosis, in terms of the model parameters. The second type are function-valued quantile diffusions and are driven by stochastic parameter processes, which determine the entire quantile function at each point in time. By the proposed innovative and simple -- yet powerful -- construction method, quantile processes are obtained by transforming the marginals of a diffusion process under a composite map consisting of a distribution and a quantile function. Such maps, analogous to rank transmutation maps, produce the marginals of the resulting quantile process. We discuss the relationship and differences between our approach and existing methods and characterisations of quantile processes in discrete and continuous time. As an example of an application of quantile diffusions, we show how probability measure distortions, a form of dynamic tilting, can be induced. Though particularly useful in financial mathematics and actuarial science, examples of which are given in this work, measure distortions feature prominently across multiple research areas. For instance, dynamic distributional approximations (statistics), non-parametric and asymptotic analysis (mathematical statistics), dynamic risk measures (econometrics), behavioural economics, decision making (operations research), signal processing (information theory), and not least in general risk theory including applications thereof, for example in the context of climate change.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

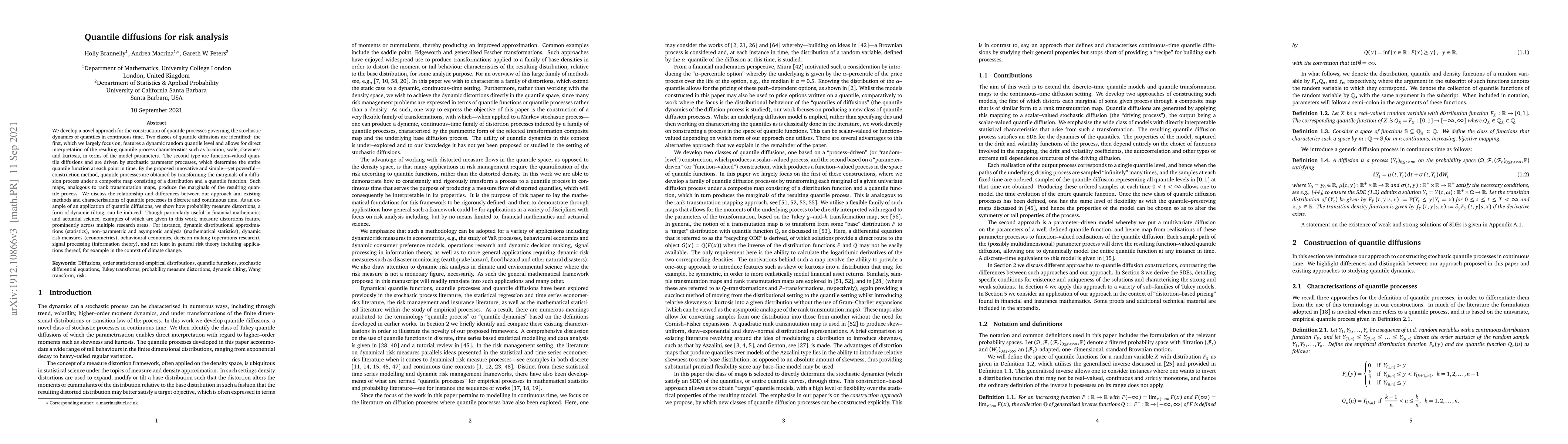

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisk Bounds for Quantile Additive Trend Filtering

Zhi Zhang, Oscar Hernan Madrid Padilla, Kyle Ritscher

| Title | Authors | Year | Actions |

|---|

Comments (0)