Summary

In the paper a problem of risk measures on a discrete-time market model with transaction costs is studied. Strategy effectiveness and shortfall risk is introduced. This paper is a generalization of quantile hedging presented in [4].

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

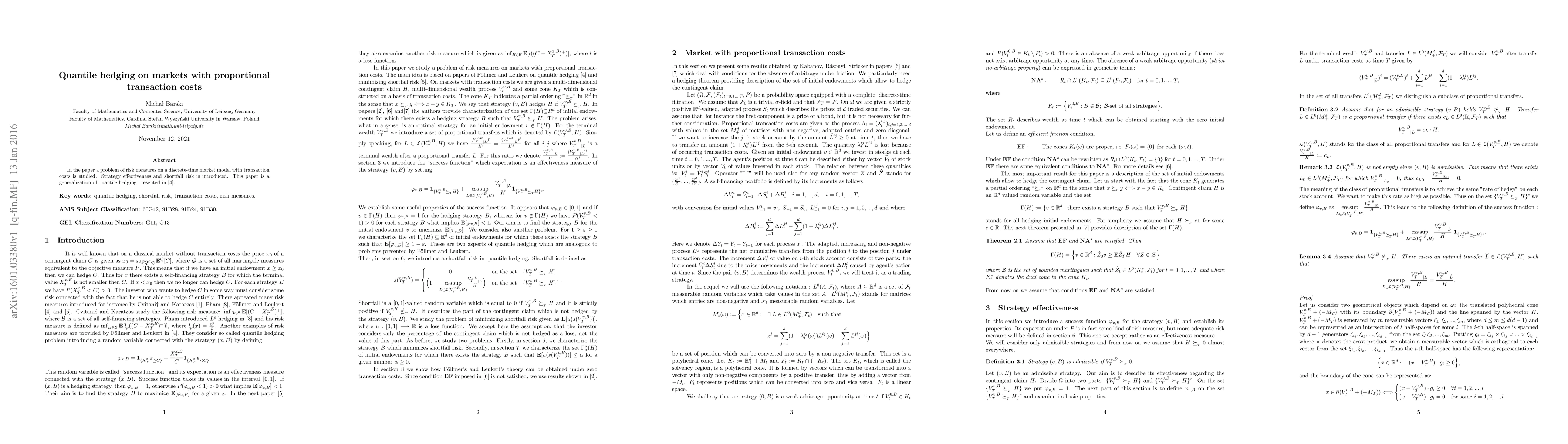

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)