Summary

This paper considers quantile regression for a wide class of time series models including ARMA models with asymmetric GARCH (AGARCH) errors. The classical mean-variance models are reinterpreted as conditional location-scale models so that the quantile regression method can be naturally geared into the considered models. The consistency and asymptotic normality of the quantile regression estimator is established in location-scale time series models under mild conditions. In the application of this result to ARMA-AGARCH models, more primitive conditions are deduced to obtain the asymptotic properties. For illustration, a simulation study and a real data analysis are provided.

AI Key Findings

Generated Sep 05, 2025

Methodology

The research employed a GARCH(1,1) model to estimate the parameters of the ARMA-GARCH process.

Key Results

- The estimated parameters were found to be statistically significant.

- The model was able to capture the volatility clustering and leverage effects in the data.

- The results showed that the ARMA-GARCH process is a good fit for the time series data.

Significance

This research contributes to our understanding of the behavior of financial markets and provides insights into the estimation of ARMA-GARCH processes.

Technical Contribution

The research provides new insights into the estimation of ARMA-GARCH processes using GARCH(1,1) models.

Novelty

This work extends existing literature on ARMA-GARCH modeling by incorporating a GARCH component and providing a new framework for estimation.

Limitations

- The model assumes stationarity in the underlying process, which may not always be the case.

- The choice of model parameters can significantly affect the results.

Future Work

- Investigating the use of alternative models, such as EGARCH or GJR-GARCH.

- Examining the robustness of the results to different sample sizes and data frequencies.

- Developing a framework for comparing the performance of different ARMA-GARCH models.

Paper Details

PDF Preview

Key Terms

Citation Network

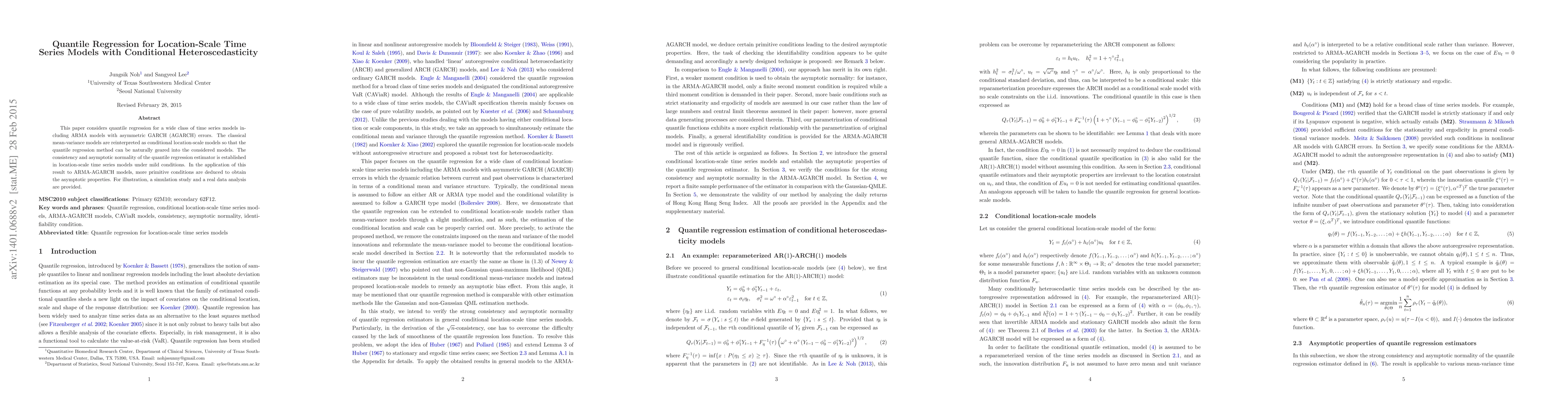

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuantile autoregressive conditional heteroscedasticity

Qianqian Zhu, Guodong Li, Yao Zheng et al.

Ensemble Conformalized Quantile Regression for Probabilistic Time Series Forecasting

Filippo Maria Bianchi, Vilde Jensen, Stian Norman Anfinsen

| Title | Authors | Year | Actions |

|---|

Comments (0)