Summary

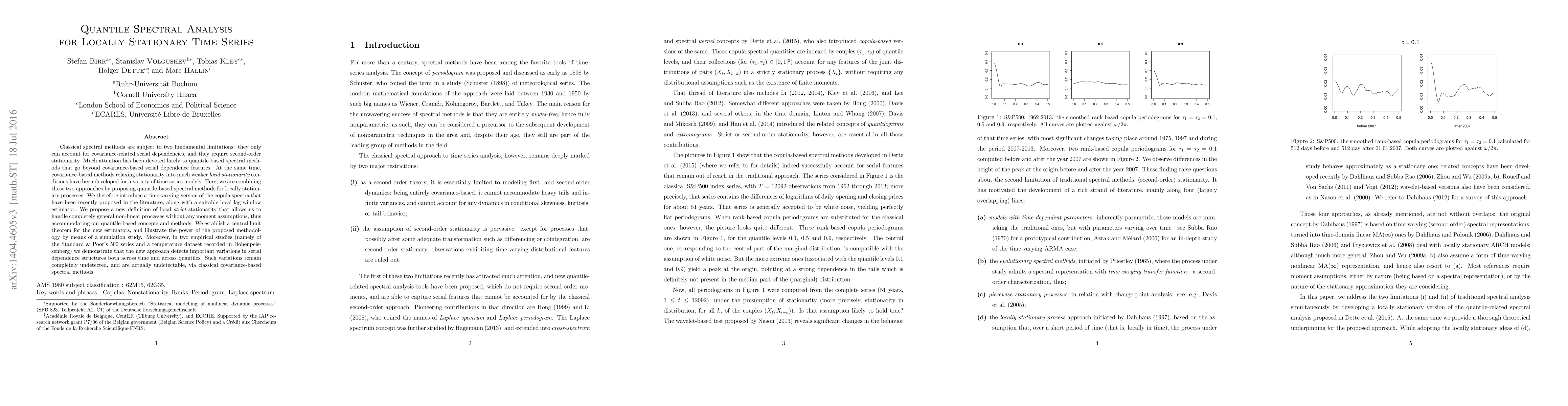

Classical spectral methods are subject to two fundamental limitations: they only can account for covariance-related serial dependencies, and they require second-order stationarity. Much attention has been devoted lately to quantile-based spectral methods that go beyond covariance-based serial dependence features. At the same time, covariance-based methods relaxing stationarity into much weaker {\it local stationarity} conditions have been developed for a variety of time-series models. Here, we are combining those two approaches by proposing quantile-based spectral methods for locally stationary processes. We therefore introduce a time-varying version of the copula spectra that have been recently proposed in the literature, along with a suitable local lag-window estimator. We propose a new definition of local {\it strict} stationarity that allows us to handle completely general non-linear processes without any moment assumptions, thus accommodating our quantile-based concepts and methods. We establish a central limit theorem for the new estimators, and illustrate the power of the proposed methodology by means of a simulation study. Moreover, in two empirical studies (namely of the Standard \& Poor's 500 series and a temperature dataset recorded in Hohenpeissenberg) we demonstrate that the new approach detects important variations in serial dependence structures both across time and across quantiles. Such variations remain completely undetected, and are actually undetectable, via classical covariance-based spectral methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)