Summary

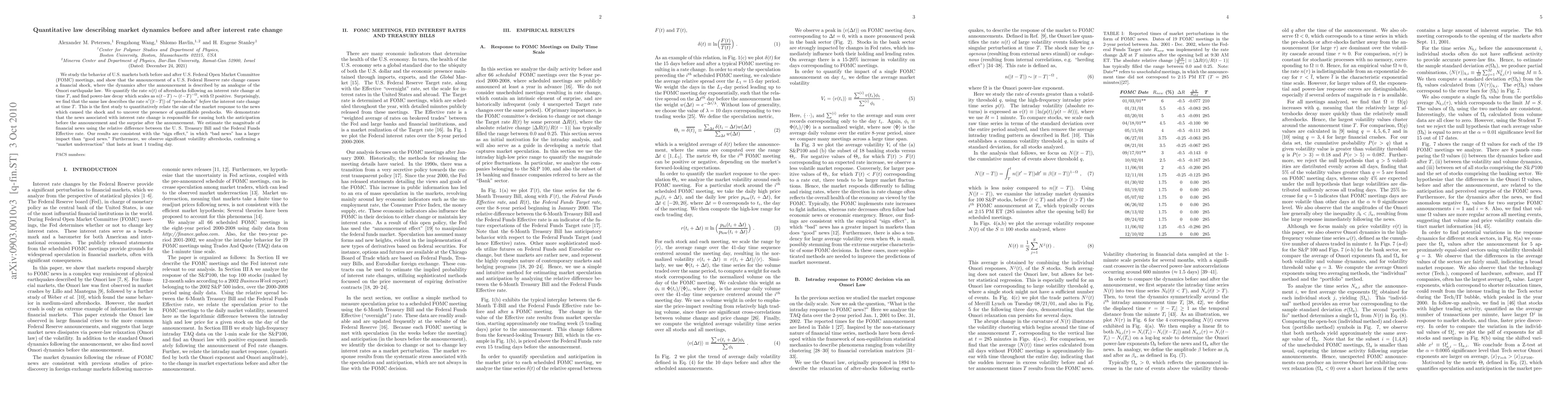

We study the behavior of U.S. markets both before and after U.S. Federal Open Market Committee (FOMC) meetings, and show that the announcement of a U.S. Federal Reserve rate change causes a financial shock, where the dynamics after the announcement is described by an analogue of the Omori earthquake law. We quantify the rate n(t) of aftershocks following an interest rate change at time T, and find power-law decay which scales as n(t-T) (t-T)^-$\Omega$, with $\Omega$ positive. Surprisingly, we find that the same law describes the rate n'(|t-T|) of "pre-shocks" before the interest rate change at time T. This is the first study to quantitatively relate the size of the market response to the news which caused the shock and to uncover the presence of quantifiable preshocks. We demonstrate that the news associated with interest rate change is responsible for causing both the anticipation before the announcement and the surprise after the announcement. We estimate the magnitude of financial news using the relative difference between the U. S. Treasury Bill and the Federal Funds Effective rate. Our results are consistent with the "sign effect," in which "bad news" has a larger impact than "good news." Furthermore, we observe significant volatility aftershocks, confirming a "market underreaction" that lasts at least 1 trading day.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInterest Rate Dynamics and Commodity Prices

John Stachurski, Christophe Gouel, Qingyin Ma

| Title | Authors | Year | Actions |

|---|

Comments (0)