Summary

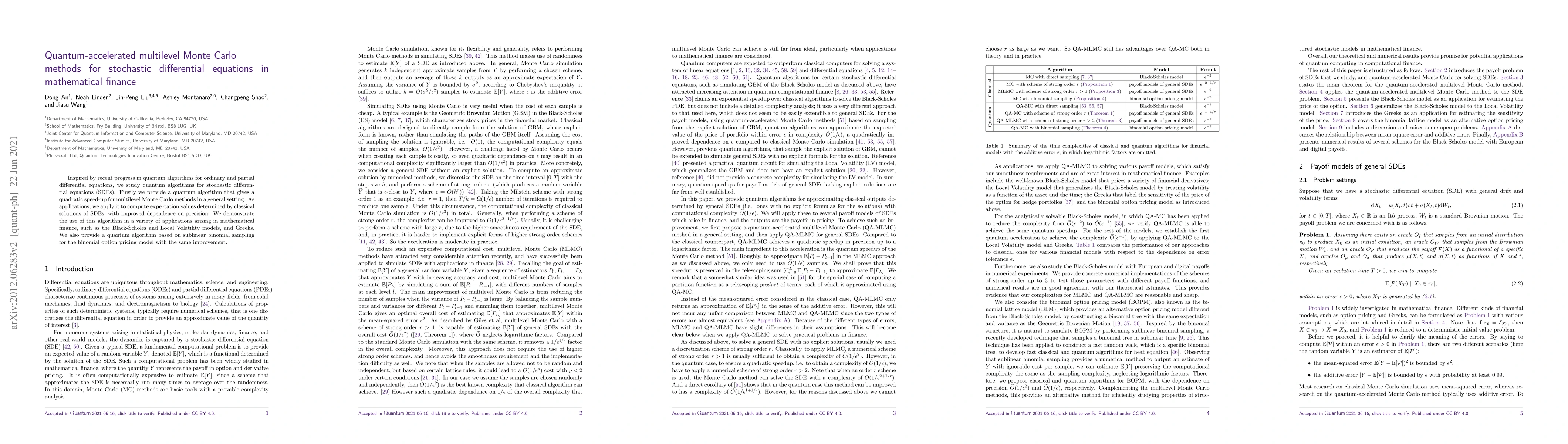

Inspired by recent progress in quantum algorithms for ordinary and partial differential equations, we study quantum algorithms for stochastic differential equations (SDEs). Firstly we provide a quantum algorithm that gives a quadratic speed-up for multilevel Monte Carlo methods in a general setting. As applications, we apply it to compute expectation values determined by classical solutions of SDEs, with improved dependence on precision. We demonstrate the use of this algorithm in a variety of applications arising in mathematical finance, such as the Black-Scholes and Local Volatility models, and Greeks. We also provide a quantum algorithm based on sublinear binomial sampling for the binomial option pricing model with the same improvement.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)