Authors

Summary

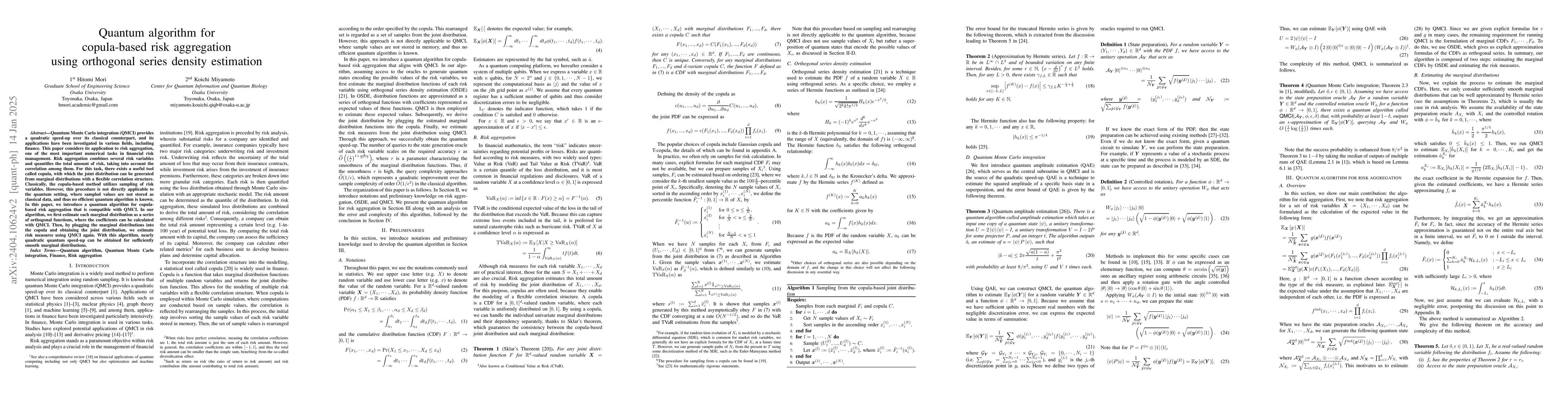

Quantum Monte Carlo integration (QMCI) provides a quadratic speed-up over its classical counterpart, and its applications have been investigated in various fields, including finance. This paper considers its application to risk aggregation, one of the most important numerical tasks in financial risk management. Risk aggregation combines several risk variables and quantifies the total amount of risk, taking into account the correlation among them. For this task, there exists a useful tool called copula, with which the joint distribution can be generated from marginal distributions with a flexible correlation structure. Classically, the copula-based method utilizes sampling of risk variables. However, this procedure is not directly applicable to the quantum setting, where sampled values are not stored as classical data, and thus no efficient quantum algorithm is known. In this paper, we propose a quantum algorithm for copula-based risk aggregation that is compatible with QMCI. In our algorithm, we first estimate each marginal distribution as a series of orthogonal functions, where the coefficients can be calculated with QMCI. Then, by plugging the marginal distributions into the copula and obtaining the joint distribution, we estimate risk measures using QMCI again. With this algorithm, nearly quadratic quantum speed-up can be obtained for sufficiently smooth marginal distributions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCopula-based Risk Aggregation with Trapped Ion Quantum Computers

Daiwei Zhu, Sonika Johri, Annarita Giani et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)