Authors

Summary

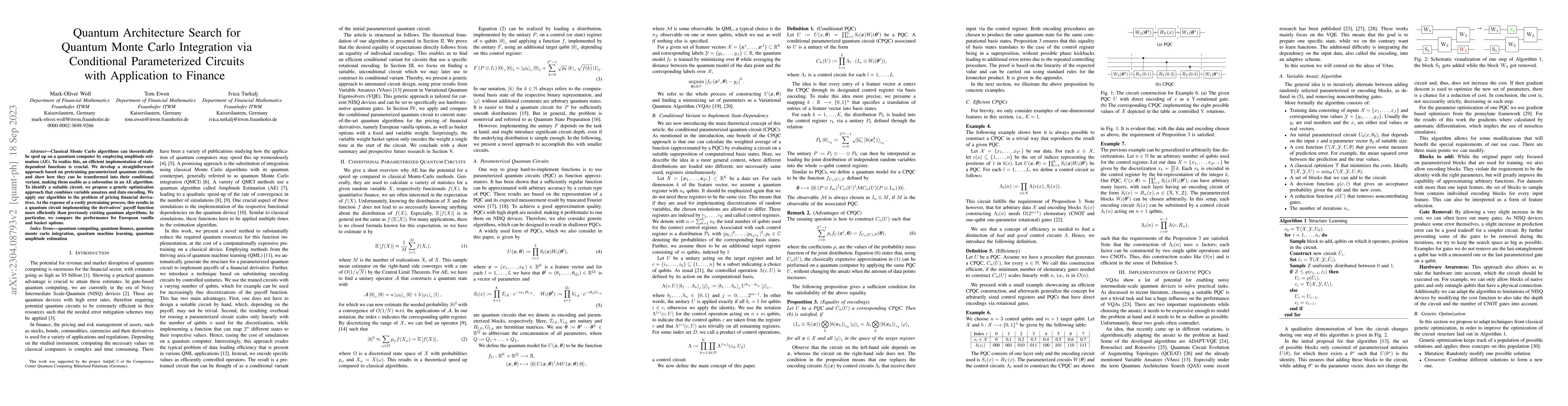

Classical Monte Carlo algorithms can theoretically be sped up on a quantum computer by employing amplitude estimation (AE). To realize this, an efficient implementation of state-dependent functions is crucial. We develop a straightforward approach based on pretraining parameterized quantum circuits, and show how they can be transformed into their conditional variant, making them usable as a subroutine in an AE algorithm. To identify a suitable circuit, we propose a genetic optimization approach that combines variable ansatzes and data encoding. We apply our algorithm to the problem of pricing financial derivatives. At the expense of a costly pretraining process, this results in a quantum circuit implementing the derivatives' payoff function more efficiently than previously existing quantum algorithms. In particular, we compare the performance for European vanilla and basket options.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Modular Engine for Quantum Monte Carlo Integration

Michael Spranger, Conor Mc Keever, Michael Lubasch et al.

Application of ZX-calculus to Quantum Architecture Search

Tom Ewen, Ivica Turkalj, Patrick Holzer et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)