Summary

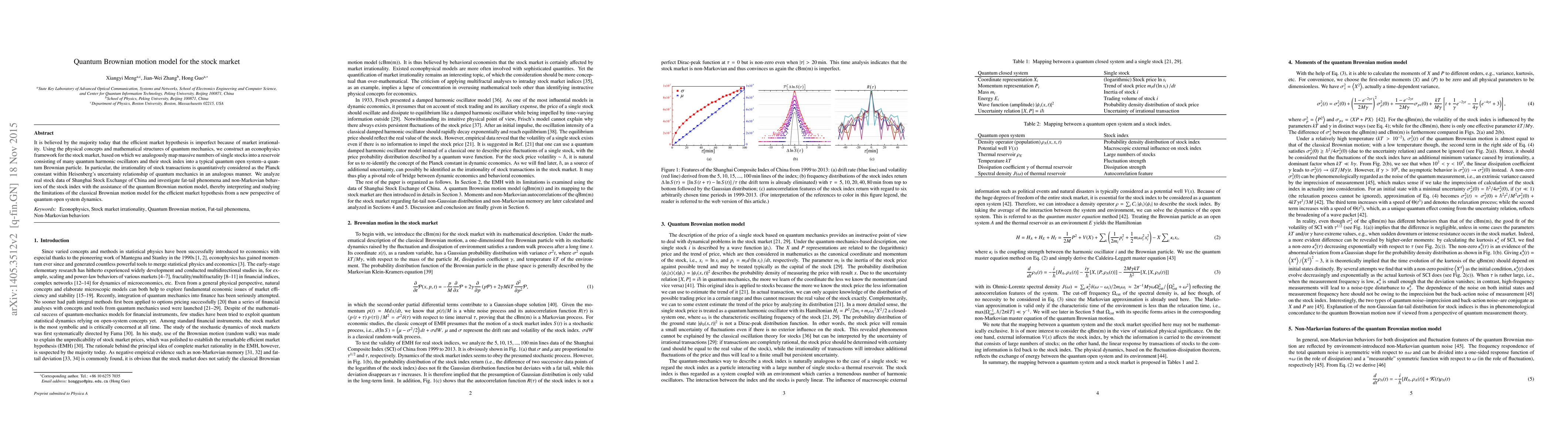

It is believed by the majority today that the efficient market hypothesis is imperfect because of market irrationality. Using the physical concepts and mathematical structures of quantum mechanics, we construct an econophysics framework for the stock market, based on which we analogously map massive numbers of single stocks into a reservoir consisting of many quantum harmonic oscillators and their stock index into a typical quantum open system--a quantum Brownian particle. In particular, the irrationality of stock transactions is quantitatively considered as the Planck constant within Heisenberg's uncertainty relationship of quantum mechanics in an analogous manner. We analyze real stock data of Shanghai Stock Exchange of China and investigate fat-tail phenomena and non-Markovian behaviors of the stock index with the assistance of the quantum Brownian motion model, thereby interpreting and studying the limitations of the classical Brownian motion model for the efficient market hypothesis from a new perspective of quantum open system dynamics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)