Authors

Summary

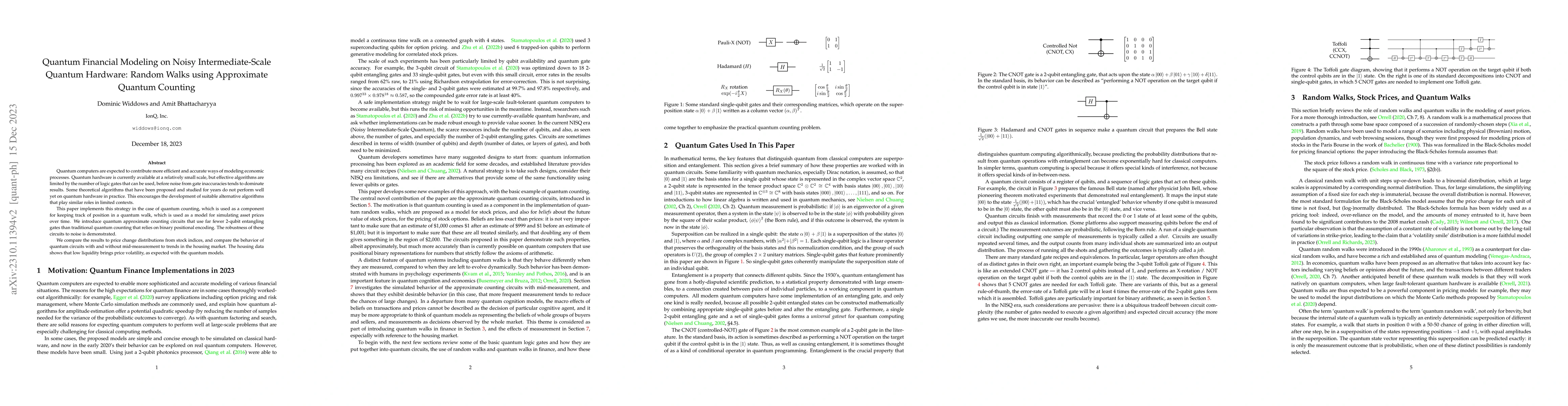

Quantum computers are expected to contribute more efficient and accurate ways of modeling economic processes. Quantum hardware is currently available at a relatively small scale, but effective algorithms are limited by the number of logic gates that can be used, before noise from gate inaccuracies tends to dominate results. Some theoretical algorithms that have been proposed and studied for years do not perform well yet on quantum hardware in practice. This encourages the development of suitable alternative algorithms that play similar roles in limited contexts. This paper implements this strategy in the case of quantum counting, which is used as a component for keeping track of position in a quantum walk, which is used as a model for simulating asset prices over time. We introduce quantum approximate counting circuits that use far fewer 2-qubit entangling gates than traditional quantum counting that relies on binary positional encoding. The robustness of these circuits to noise is demonstrated. We compare the results to price change distributions from stock indices, and compare the behavior of quantum circuits with and without mid-measurement to trends in the housing market. The housing data shows that low liquidity brings price volatility, as expected with the quantum models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersPractical Quantum Search by Variational Quantum Eigensolver on Noisy Intermediate-scale Quantum Hardware

Chen-Yu Liu

Quantum search on noisy intermediate-scale quantum devices

Kun Zhang, Kwangmin Yu, Vladimir Korepin

Comments (0)