Summary

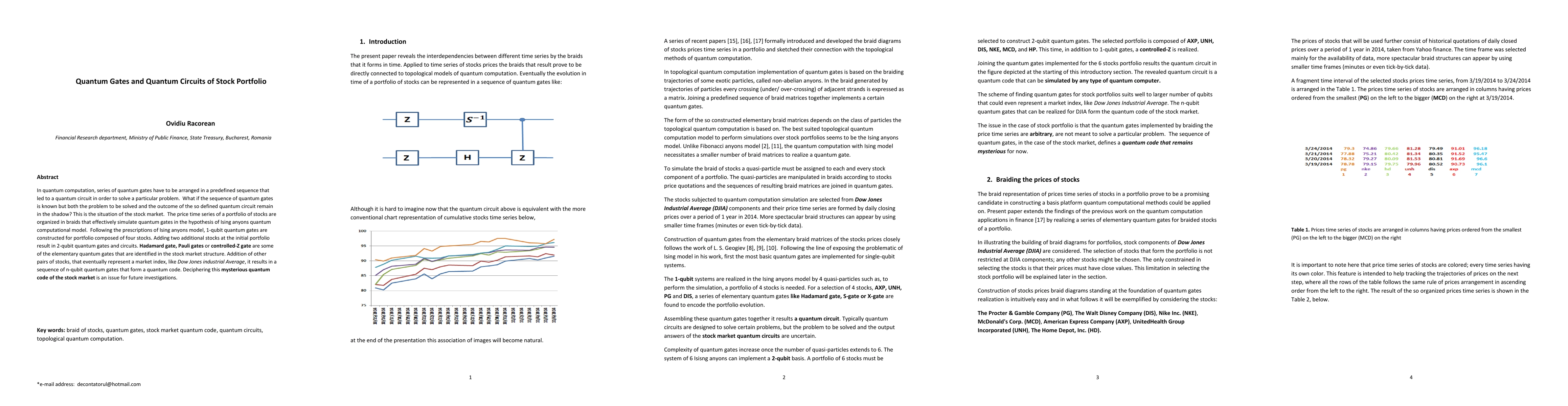

In quantum computation, series of quantum gates have to be arranged in a predefined sequence that led to a quantum circuit in order to solve a particular problem. What if the sequence of quantum gates is known but both the problem to be solved and the outcome of the so defined quantum circuit remain in the shadow? This is the situation of the stock market. The price time series of a portfolio of stocks are organized in braids that effectively simulate quantum gates in the hypothesis of Ising anyons quantum computational model. Following the prescriptions of Ising anyons model, 1-qubit quantum gates are constructed for portfolio composed of four stocks. Adding two additional stocks at the initial portfolio result in 2-qubits quantum gates and circuits. Hadamard gate, Pauli gates or controlled-Z gate are some of the elementary quantum gates that are identified in the stock market structure. Addition of other pairs of stocks, that eventually represent a market index, like Dow Jones industrial Average, it results in a sequence of n-qubits quantum gates that form a quantum code. Deciphering this mysterious quantum code of the stock market is an issue for future investigations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConvergence efficiency of quantum gates and circuits

Zi-Wen Liu, Zimu Li, Linghang Kong

| Title | Authors | Year | Actions |

|---|

Comments (0)