Summary

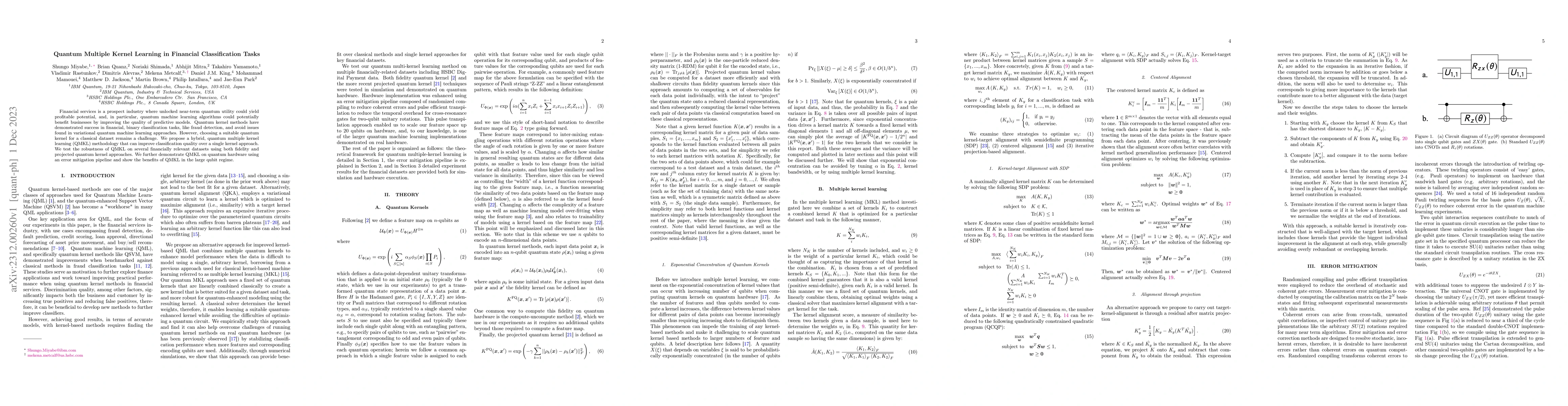

Financial services is a prospect industry where unlocked near-term quantum utility could yield profitable potential, and, in particular, quantum machine learning algorithms could potentially benefit businesses by improving the quality of predictive models. Quantum kernel methods have demonstrated success in financial, binary classification tasks, like fraud detection, and avoid issues found in variational quantum machine learning approaches. However, choosing a suitable quantum kernel for a classical dataset remains a challenge. We propose a hybrid, quantum multiple kernel learning (QMKL) methodology that can improve classification quality over a single kernel approach. We test the robustness of QMKL on several financially relevant datasets using both fidelity and projected quantum kernel approaches. We further demonstrate QMKL on quantum hardware using an error mitigation pipeline and show the benefits of QMKL in the large qubit regime.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBenchmarking quantum machine learning kernel training for classification tasks

Diego Alvarez-Estevez

Quantum-Classical Multiple Kernel Learning

Juan Carrasquilla, Jack S. Baker, Santosh Kumar Radha et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)