Summary

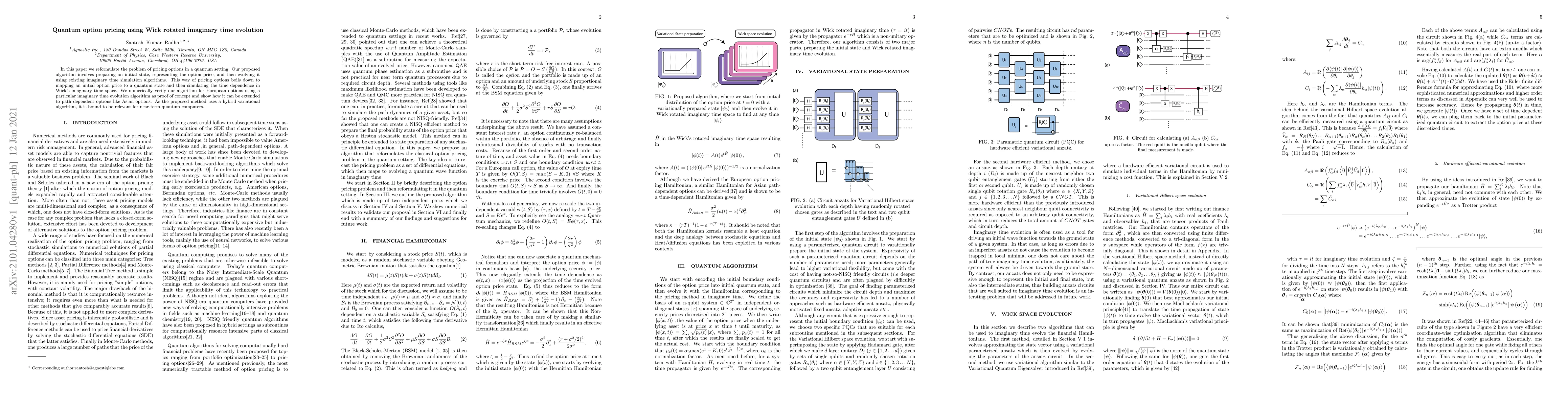

In this paper we reformulate the problem of pricing options in a quantum setting. Our proposed algorithm involves preparing an initial state, representing the option price, and then evolving it using existing imaginary time simulation algorithms. This way of pricing options boils down to mapping an initial option price to a quantum state and then simulating the time dependence in Wick's imaginary time space. We numerically verify our algorithm for European options using a particular imaginary time evolution algorithm as proof of concept and show how it can be extended to path dependent options like Asian options. As the proposed method uses a hybrid variational algorithm, it is bound to be relevant for near-term quantum computers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTime series generation for option pricing on quantum computers using tensor network

Koichi Miyamoto, Nozomu Kobayashi, Yoshiyuki Suimon

Adiabatic quantum imaginary time evolution

Garnet Kin-Lic Chan, Kasra Hejazi, Mario Motta

Quantum Imaginary-Time Evolution with Polynomial Resources in Time

Lei Zhang, Xin Wang, Xian Wu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)