Summary

This paper describes an approach to economics that is inspired by quantum computing, and is motivated by the need to develop a consistent quantum mathematical framework for economics. The traditional neoclassical approach assumes that rational utility-optimisers drive market prices to a stable equilibrium, subject to external perturbations. While this approach has been highly influential, it has come under increasing criticism following the financial crisis of 2007/8. The quantum approach, in contrast, is inherently probabilistic and dynamic. Decision-makers are described, not by a utility function, but by a propensity function which specifies the probability of transacting. We show how a number of cognitive phenomena such as preference reversal and the disjunction effect can be modelled by using a simple quantum circuit to generate an appropriate propensity function. Conversely, a general propensity function can be quantized to incorporate effects such as interference and entanglement that characterise human decision-making. Applications to some common problems in economics and finance are discussed.

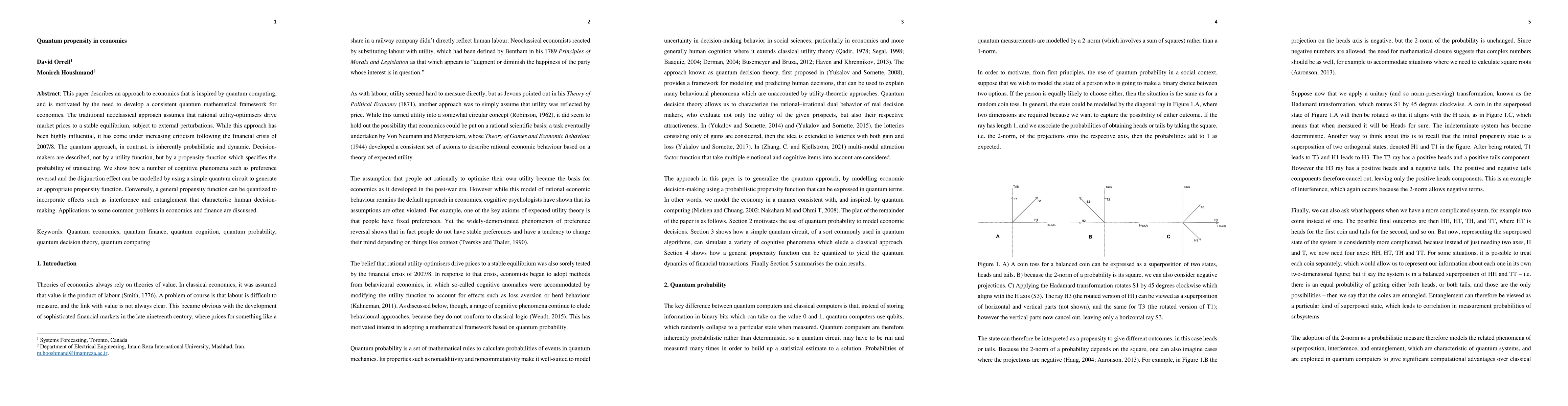

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)