Summary

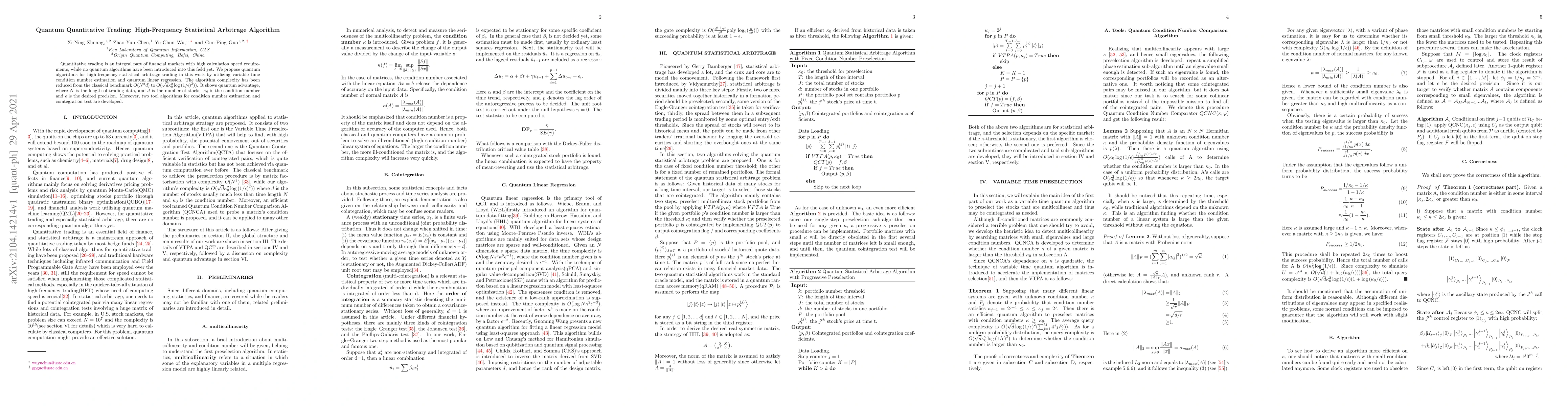

Quantitative trading is an integral part of financial markets with high calculation speed requirements, while no quantum algorithms have been introduced into this field yet. We propose quantum algorithms for high-frequency statistical arbitrage trading in this work by utilizing variable time condition number estimation and quantum linear regression.The algorithm complexity has been reduced from the classical benchmark O(N^2d) to O(sqrt(d)(kappa)^2(log(1/epsilon))^2 )). It shows quantum advantage, where N is the length of trading data, and d is the number of stocks, kappa is the condition number and epsilon is the desired precision. Moreover, two tool algorithms for condition number estimation and cointegration test are developed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHarnessing Deep Q-Learning for Enhanced Statistical Arbitrage in High-Frequency Trading: A Comprehensive Exploration

Soumyadip Sarkar

Deep Learning Statistical Arbitrage

Markus Pelger, Greg Zanotti, Jorge Guijarro-Ordonez

C++ Design Patterns for Low-latency Applications Including High-frequency Trading

Paul Bilokon, Burak Gunduz

Statistical arbitrage in multi-pair trading strategy based on graph clustering algorithms in US equities market

Robert Ślepaczuk, Adam Korniejczuk

| Title | Authors | Year | Actions |

|---|

Comments (0)