Authors

Summary

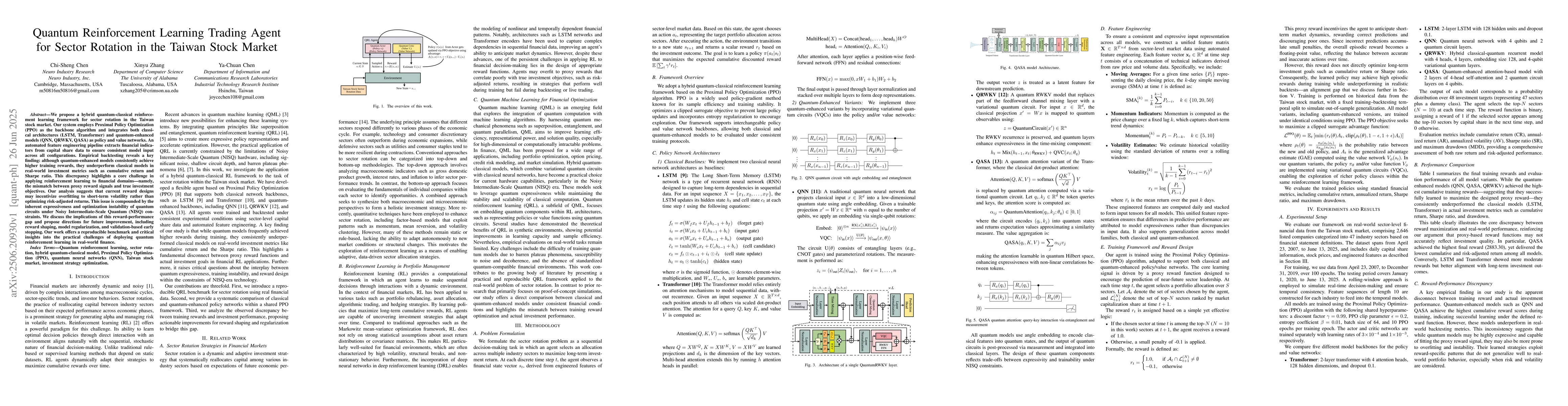

We propose a hybrid quantum-classical reinforcement learning framework for sector rotation in the Taiwan stock market. Our system employs Proximal Policy Optimization (PPO) as the backbone algorithm and integrates both classical architectures (LSTM, Transformer) and quantum-enhanced models (QNN, QRWKV, QASA) as policy and value networks. An automated feature engineering pipeline extracts financial indicators from capital share data to ensure consistent model input across all configurations. Empirical backtesting reveals a key finding: although quantum-enhanced models consistently achieve higher training rewards, they underperform classical models in real-world investment metrics such as cumulative return and Sharpe ratio. This discrepancy highlights a core challenge in applying reinforcement learning to financial domains -- namely, the mismatch between proxy reward signals and true investment objectives. Our analysis suggests that current reward designs may incentivize overfitting to short-term volatility rather than optimizing risk-adjusted returns. This issue is compounded by the inherent expressiveness and optimization instability of quantum circuits under Noisy Intermediate-Scale Quantum (NISQ) constraints. We discuss the implications of this reward-performance gap and propose directions for future improvement, including reward shaping, model regularization, and validation-based early stopping. Our work offers a reproducible benchmark and critical insights into the practical challenges of deploying quantum reinforcement learning in real-world finance.

AI Key Findings

Generated Jul 02, 2025

Methodology

The study employs a hybrid quantum-classical reinforcement learning framework based on Proximal Policy Optimization (PPO), integrating classical neural architectures (LSTM, Transformer) and quantum-enhanced models (QNN, QRWKV, QASA) for policy and value networks, with automated feature engineering from financial data.

Key Results

- Quantum-enhanced models achieved higher training rewards but underperformed classical models in real-world investment metrics such as cumulative return and Sharpe ratio.

- There exists a significant disconnect between proxy reward maximization during training and actual investment performance, indicating potential overfitting and instability in quantum models.

- Classical models demonstrated more stable and better-aligned long-term investment strategies despite lower training rewards.

Significance

This research highlights the practical challenges of deploying quantum reinforcement learning in finance, emphasizing the importance of aligning reward functions with true investment objectives and informing future development of quantum financial models.

Technical Contribution

The paper presents a reproducible quantum reinforcement learning framework applied to real-world sector rotation, providing a direct comparison with classical models and insights into the reward-performance gap in quantum finance.

Novelty

This work is novel in its practical application of quantum reinforcement learning to real financial data, highlighting the discrepancy between training rewards and actual investment outcomes, and offering a comprehensive benchmark for future quantum financial algorithms.

Limitations

- Current quantum models tend to overfit proxy rewards and do not directly optimize for long-term financial performance.

- Quantum circuits under NISQ constraints exhibit optimization instability and susceptibility to noise, limiting practical benefits.

Future Work

- Explore reward shaping, regularization, and validation-based early stopping to improve real-world investment performance.

- Develop more robust quantum encoding and regularization techniques to enhance the stability and generalization of quantum models in financial tasks.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPractical Deep Reinforcement Learning Approach for Stock Trading

Xiao-Yang Liu, Shan Zhong, Hongyang Yang et al.

Deep Reinforcement Learning Approach for Trading Automation in The Stock Market

Ekrem Duman, Taylan Kabbani

No citations found for this paper.

Comments (0)