Summary

Recent advances in quantum computing have demonstrated its potential to significantly enhance the analysis and forecasting of complex classical data. Among these, quantum reservoir computing has emerged as a particularly powerful approach, combining quantum computation with machine learning for modeling nonlinear temporal dependencies in high-dimensional time series. As with many data-driven disciplines, quantitative finance and econometrics can hugely benefit from emerging quantum technologies. In this work, we investigate the application of quantum reservoir computing for realized volatility forecasting. Our model employs a fully connected transverse-field Ising Hamiltonian as the reservoir with distinct input and memory qubits to capture temporal dependencies. The quantum reservoir computing approach is benchmarked against several econometric models and standard machine learning algorithms. The models are evaluated using multiple error metrics and the model confidence set procedures. To enhance interpretability and mitigate current quantum hardware limitations, we utilize wrapper-based forward selection for feature selection, identifying optimal subsets, and quantifying feature importance via Shapley values. Our results indicate that the proposed quantum reservoir approach consistently outperforms benchmark models across various metrics, highlighting its potential for financial forecasting despite existing quantum hardware constraints. This work serves as a proof-of-concept for the applicability of quantum computing in econometrics and financial analysis, paving the way for further research into quantum-enhanced predictive modeling as quantum hardware capabilities continue to advance.

AI Key Findings

Generated Jun 08, 2025

Methodology

The research applies quantum reservoir computing using a fully connected transverse-field Ising Hamiltonian as the reservoir, employing distinct input and memory qubits to capture temporal dependencies for realized volatility forecasting. It benchmarks the quantum approach against several econometric models and standard machine learning algorithms, utilizing wrapper-based forward selection for feature selection and Shapley values for feature importance quantification.

Key Results

- The quantum reservoir computing approach consistently outperforms benchmark models across various error metrics and model confidence set procedures.

- The study demonstrates the potential of quantum computing for financial forecasting, despite current hardware constraints.

Significance

This work serves as a proof-of-concept for the applicability of quantum computing in econometrics and financial analysis, highlighting its potential to significantly enhance the analysis and forecasting of complex classical data in quantitative finance.

Technical Contribution

The development and implementation of a quantum reservoir computing model for realized volatility forecasting, benchmarked against traditional econometric models and machine learning algorithms, showcasing its superior performance.

Novelty

This research distinguishes itself by combining quantum reservoir computing with feature selection techniques like wrapper-based forward selection and Shapley value-based feature importance quantification for financial time series analysis.

Limitations

- Existing quantum hardware constraints

- Interpretability challenges addressed through wrapper-based forward selection and Shapley values

Future Work

- Further research into quantum-enhanced predictive modeling as quantum hardware capabilities advance

- Exploration of additional quantum reservoir architectures and Hamiltonians for improved performance

Paper Details

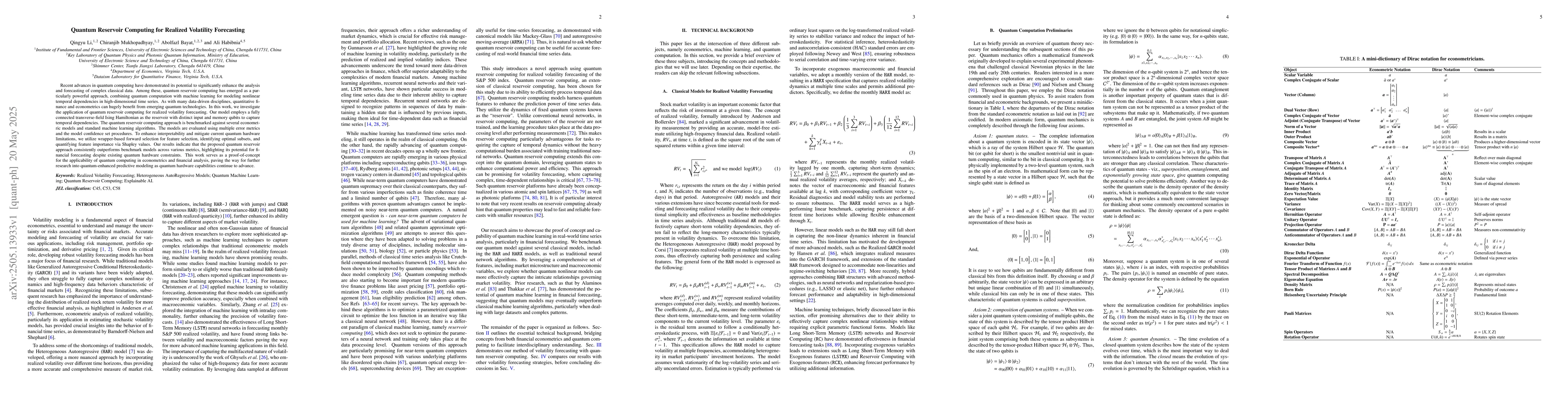

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMultivariate Realized Volatility Forecasting with Graph Neural Network

Christian-Yann Robert, Qinkai Chen

Realized Stochastic Volatility Model with Skew-t Distributions for Improved Volatility and Quantile Forecasting

Yuta Yamauchi, Yasuhiro Omori, Makoto Takahashi et al.

Quantum Next Generation Reservoir Computing: An Efficient Quantum Algorithm for Forecasting Quantum Dynamics

Thiparat Chotibut, Apimuk Sornsaeng, Ninnat Dangniam

No citations found for this paper.

Comments (0)