Summary

Decentralised exchanges (DEXs) have transformed trading by enabling trustless, permissionless transactions, yet they face significant challenges such as impermanent loss and slippage, which undermine profitability for liquidity providers and traders. In this paper, we introduce QubitSwap, an innovative DEX model designed to tackle these issues through a hybrid approach that integrates an external oracle price with internal pool dynamics. This is achieved via a parameter $z$, which governs the balance between these price sources, creating a flexible and adaptive pricing mechanism. Through rigorous mathematical analysis, we derive a novel reserve function and pricing model that substantially reduces impermanent loss and slippage compared to traditional DEX frameworks. Notably, our results show that as $z$ approaches 1, slippage approaches zero, enhancing trading stability. QubitSwap marks a novel approach in DEX design, delivering a more efficient and resilient platform. This work not only advances the theoretical foundations of decentralised finance but also provides actionable solutions for the broader DeFi ecosystem.

AI Key Findings

Generated Jun 10, 2025

Methodology

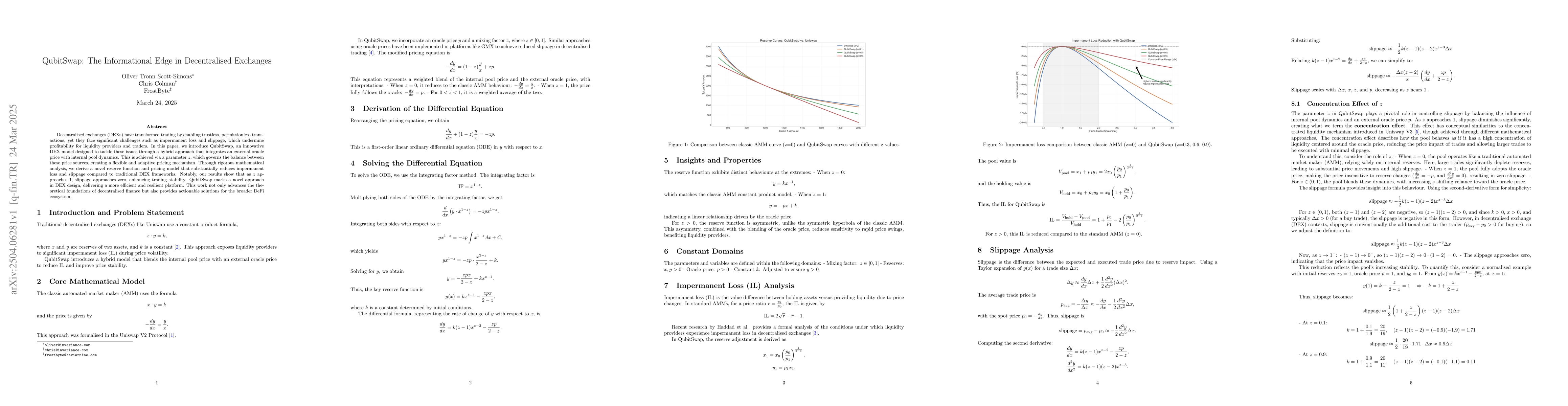

The research introduces QubitSwap, a novel DEX model that integrates an external oracle price with internal pool dynamics, governed by a mixing factor z. It uses mathematical analysis to derive a reserve function and pricing model, reducing impermanent loss and slippage.

Key Results

- QubitSwap significantly reduces impermanent loss and slippage compared to traditional DEX frameworks.

- As z approaches 1, slippage approaches zero, enhancing trading stability.

- The reserve function exhibits distinct behaviors at the extremes, reducing sensitivity to rapid price swings.

Significance

This work advances the theoretical foundations of decentralized finance and provides actionable solutions for the broader DeFi ecosystem by delivering a more efficient and resilient DEX platform.

Technical Contribution

The paper presents a novel reserve function and pricing model for DEXs, integrating an external oracle price with internal pool dynamics through a mixing factor z.

Novelty

QubitSwap introduces a hybrid DEX design that combines external oracle pricing with internal pool dynamics, offering a flexible and adaptive pricing mechanism to tackle issues like impermanent loss and slippage in traditional DEX frameworks.

Limitations

- The paper does not discuss the potential centralization risks associated with relying on external oracles.

- Practical implementation challenges, such as oracle reliability and latency, are not addressed.

Future Work

- Investigate methods to mitigate centralization risks associated with oracle usage.

- Explore the impact of oracle latency on QubitSwap's performance in real-world scenarios.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFormalising Decentralised Exchanges in Coq

Bas Spitters, Danil Annenkov, Eske Hoy Nielsen

Towards a Decentralised Application-Centric Orchestration Framework in the Cloud-Edge Continuum

Amjad Ullah, Tamas Kiss, James Deslauriers et al.

Decentralised Trustworthy Collaborative Intrusion Detection System for IoT

Salil S. Kanhere, Volkan Dedeoglu, Raja Jurdak et al.

The Role of Emotions in Informational Support Question-Response Pairs in Online Health Communities: A Multimodal Deep Learning Approach

Mohsen Jozani, Jason A. Williams, Ahmed Aleroud et al.

No citations found for this paper.

Comments (0)