Summary

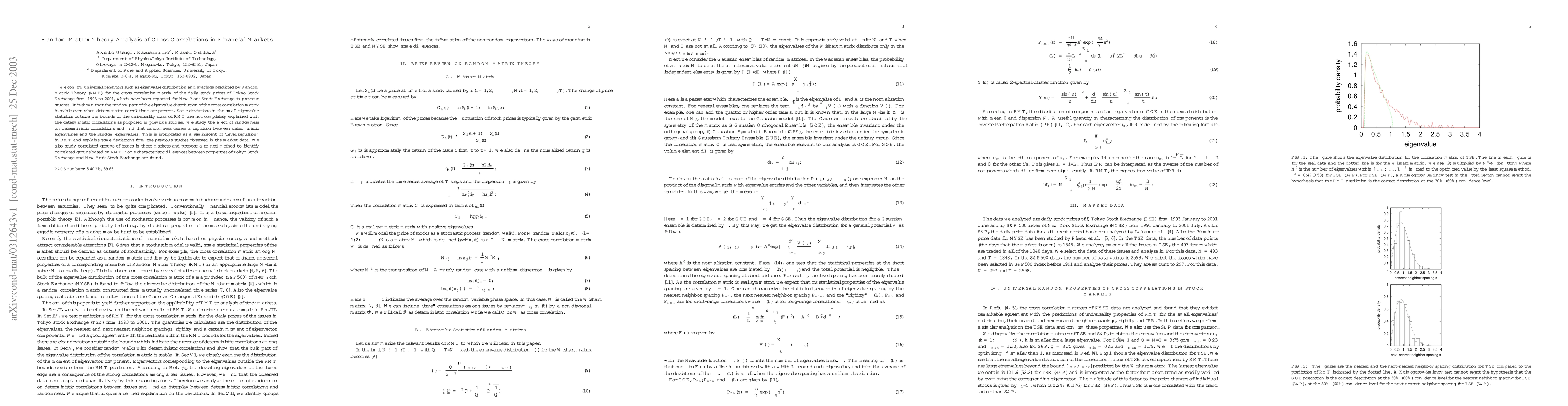

We confirm universal behaviors such as eigenvalue distribution and spacings predicted by Random Matrix Theory (RMT) for the cross correlation matrix of the daily stock prices of Tokyo Stock Exchange from 1993 to 2001, which have been reported for New York Stock Exchange in previous studies. It is shown that the random part of the eigenvalue distribution of the cross correlation matrix is stable even when deterministic correlations are present. Some deviations in the small eigenvalue statistics outside the bounds of the universality class of RMT are not completely explained with the deterministic correlations as proposed in previous studies. We study the effect of randomness on deterministic correlations and find that randomness causes a repulsion between deterministic eigenvalues and the random eigenvalues. This is interpreted as a reminiscent of ``level repulsion'' in RMT and explains some deviations from the previous studies observed in the market data. We also study correlated groups of issues in these markets and propose a refined method to identify correlated groups based on RMT. Some characteristic differences between properties of Tokyo Stock Exchange and New York Stock Exchange are found.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInvestor behavior and multiscale cross-correlations: Unveiling regime shifts in global financial markets

George Kapetanios, Marina Dolfin, Leone Leonida et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)