Summary

The present article explores the application of randomized control techniques in empirical asset pricing and performance evaluation. It introduces geometric random walks, a class of Markov chain Monte Carlo methods, to construct flexible control groups in the form of random portfolios adhering to investor constraints. The sampling-based methods enable an exploration of the relationship between academically studied factor premia and performance in a practical setting. In an empirical application, the study assesses the potential to capture premias associated with size, value, quality, and momentum within a strongly constrained setup, exemplified by the investor guidelines of the MSCI Diversified Multifactor index. Additionally, the article highlights issues with the more traditional use case of random portfolios for drawing inferences in performance evaluation, showcasing challenges related to the intricacies of high-dimensional geometry.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

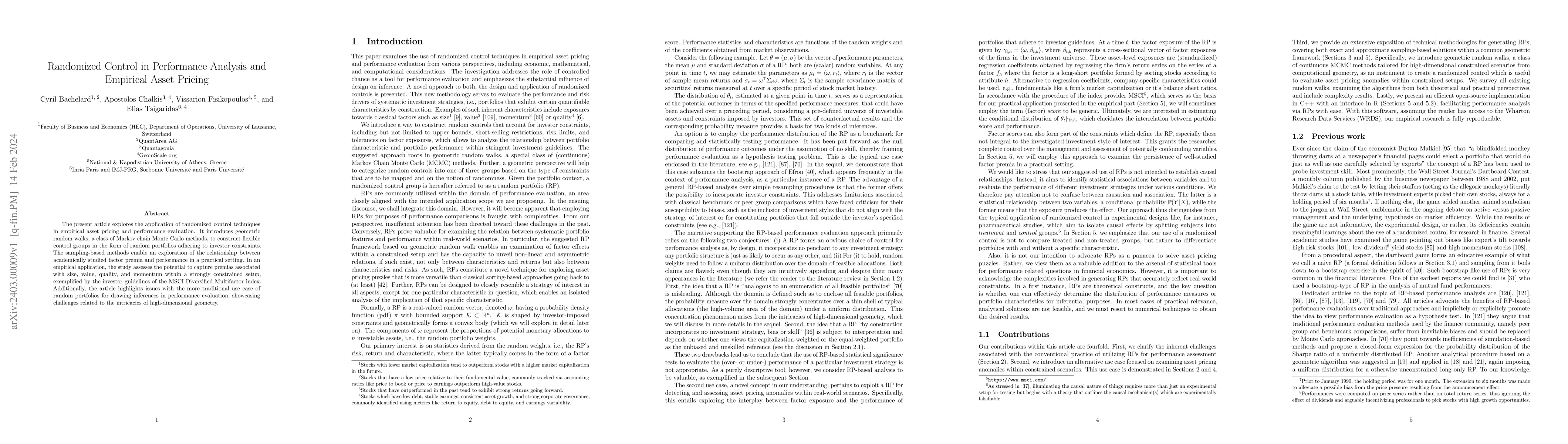

PDF Preview

Key Terms

Similar Papers

Found 4 papersDeep Partial Least Squares for Empirical Asset Pricing

Nicholas G. Polson, Matthew F. Dixon, Kemen Goicoechea

| Title | Authors | Year | Actions |

|---|

Comments (0)