Summary

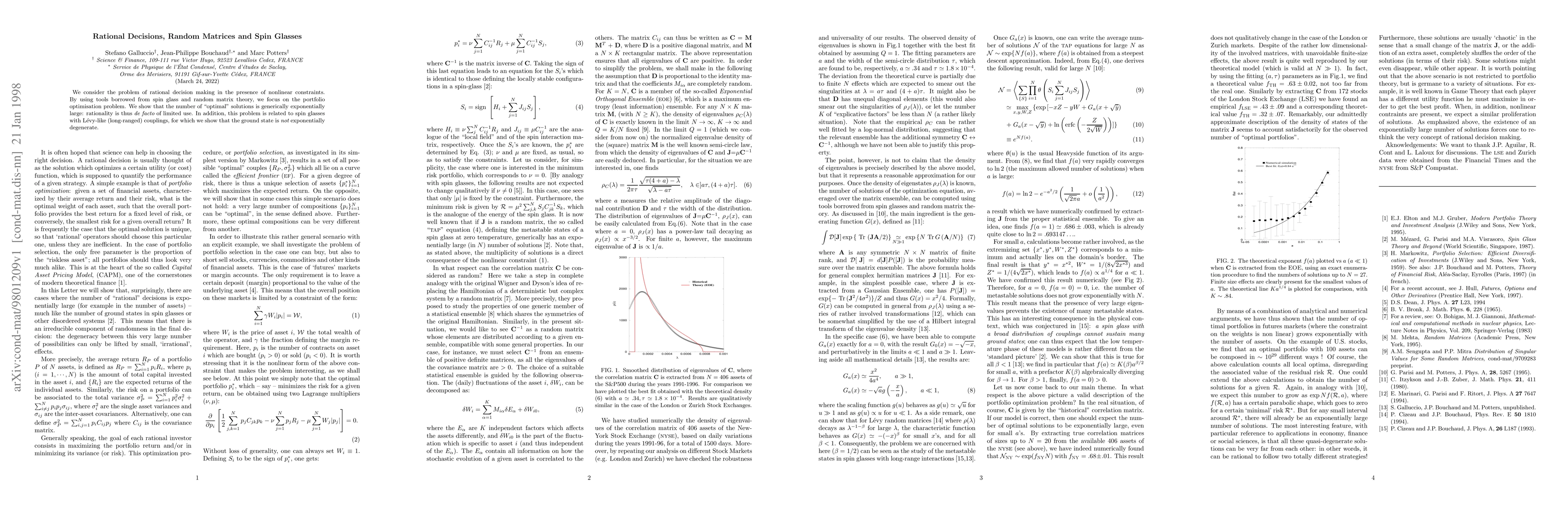

We consider the problem of rational decision making in the presence of nonlinear constraints. By using tools borrowed from spin glass and random matrix theory, we focus on the portfolio optimisation problem. We show that the number of ``optimal'' solutions is generically exponentially large: rationality is thus de facto of limited use. In addition, this problem is related to spin glasses with L\'evy-like (long-ranged) couplings, for which we show that the ground state is not exponentially degenerate.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)