Authors

Summary

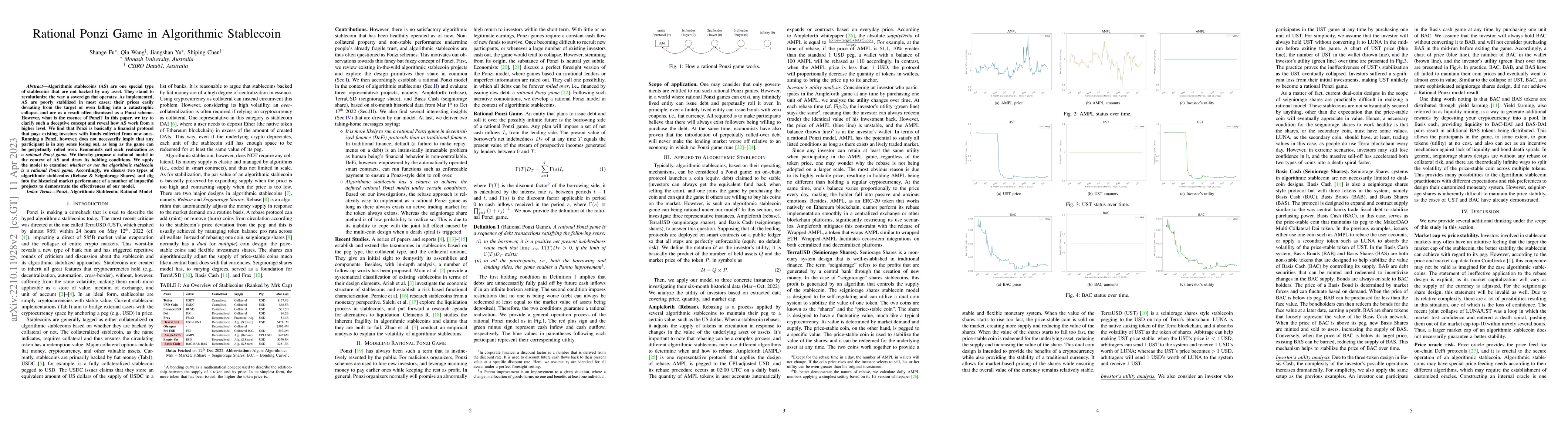

Algorithmic stablecoins (AS) are one special type of stablecoins that are not backed by any asset (equiv. without collateral). They stand to revolutionize the way a sovereign fiat operates. As implemented, these coins are poorly stabilized in most cases, easily deviating from the price target or even falling into a catastrophic collapse (a.k.a. Death spiral), and are as a result dismissed as a Ponzi scheme. However, is this the whole picture? In this paper, we try to reveal the truth and clarify such a deceptive concept. We find that Ponzi is basically a financial protocol that pays existing investors with funds collected from new ones. Running a Ponzi, however, does not necessarily imply that any participant is in any sense losing out, as long as the game can be perpetually rolled over. Economists call such realization as a \textit{rational Ponzi game}. We thereby propose a rational model in the context of AS and draw its holding conditions. We apply the model to examine: \textit{whether or not the algorithmic stablecoin is a rational Ponzi game.} Accordingly, we discuss two types of algorithmic stablecoins (\text{Rebase} \& \text{Seigniorage shares}) and dig into the historical market performance of two impactful projects (\text{Ampleforth} \& \text{TerraUSD}, respectively) to demonstrate the effectiveness of our model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHeterogeneous Feature Augmentation for Ponzi Detection in Ethereum

Qi Xuan, Jiajun Zhou, Chengxiang Jin et al.

No citations found for this paper.

Comments (0)