Summary

Assuming that agents' preferences satisfy first-order stochastic dominance, we show how the Expected Utility paradigm can rationalize all optimal investment choices: the optimal investment strategy in any behavioral law-invariant (state-independent) setting corresponds to the optimum for an expected utility maximizer with an explicitly derived concave non-decreasing utility function. This result enables us to infer the utility and risk aversion of agents from their investment choice in a non-parametric way. We relate the property of decreasing absolute risk aversion (DARA) to distributional properties of the terminal wealth and of the financial market. Specifically, we show that DARA is equivalent to a demand for a terminal wealth that has more spread than the opposite of the log pricing kernel at the investment horizon.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

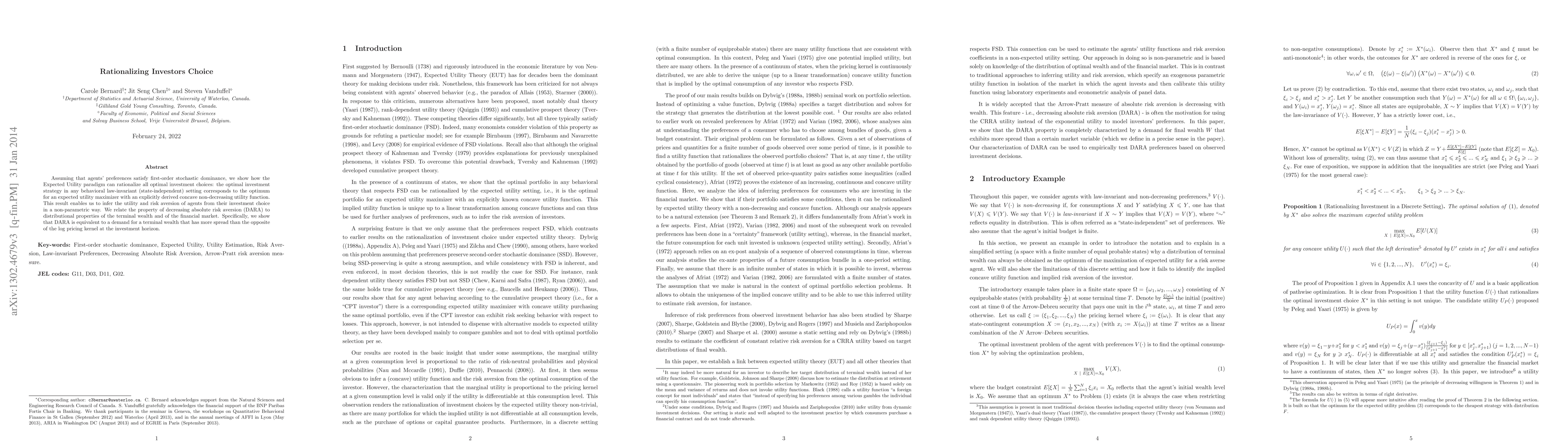

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRationalizing Path-Independent Choice Rules

Fuhito Kojima, Koji Yokote, Isa E. Hafalir et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)