Summary

In this paper we analyze from the game theory point of view Byzantine Fault Tolerant blockchains when processes exhibit rational or Byzantine behavior. Our work is the first to model the Byzantine-consensus based blockchains as a committee coordination game. Our first contribution is to offer a game-theoretical methodology to analyse equilibrium interactions between Byzantine and rational committee members in Byzantine Fault Tolerant blockchains. Byzantine processes seek to inflict maximum damage to the system, while rational processes best-respond to maximise their expected net gains. Our second contribution is to derive conditions under which consensus properties are satisfied or not in equilibrium. When the majority threshold is lower than the proportion of Byzantine processes, invalid blocks are accepted in equilibrium. When the majority threshold is large, equilibrium can involve coordination failures , in which no block is ever accepted. However, when the cost of accepting invalid blocks is large, there exists an equilibrium in which blocks are accepted iff they are valid.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

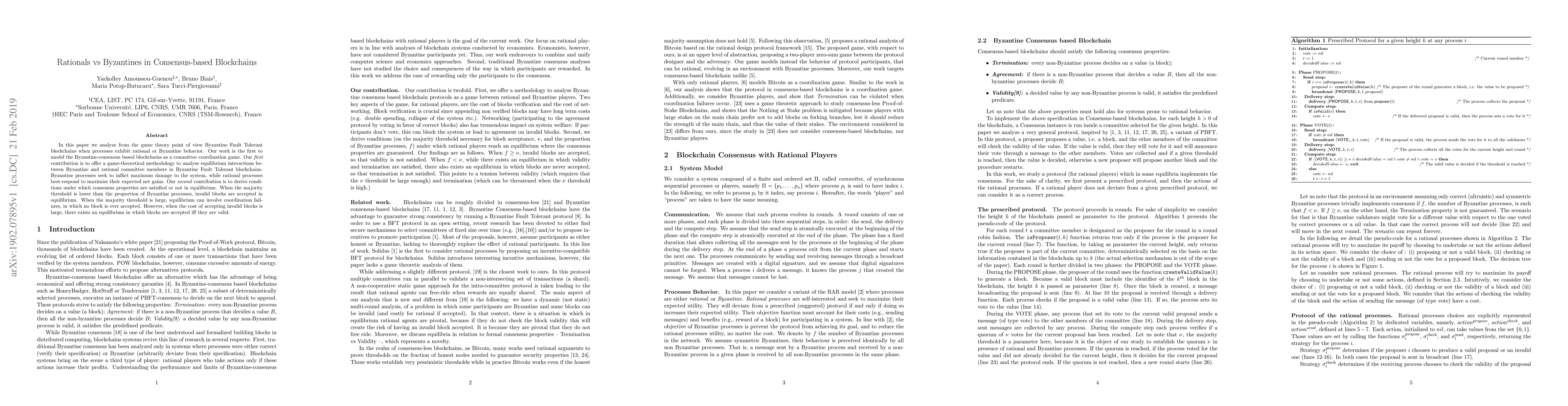

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSoK: Achieving State Machine Replication in Blockchains based on Repeated Consensus

Antonella Del Pozzo, Álvaro García-Pérez, Sara Tucci-Piergiovanni et al.

Scaling Blockchains: Can Committee-Based Consensus Help?

Alon Benhaim, Brett Hemenway Falk, Gerry Tsoukalas

A Consensus-Based Load-Balancing Algorithm for Sharded Blockchains

Q. L. Nguyen, M. Toulouse, H. K. Dai

| Title | Authors | Year | Actions |

|---|

Comments (0)