Summary

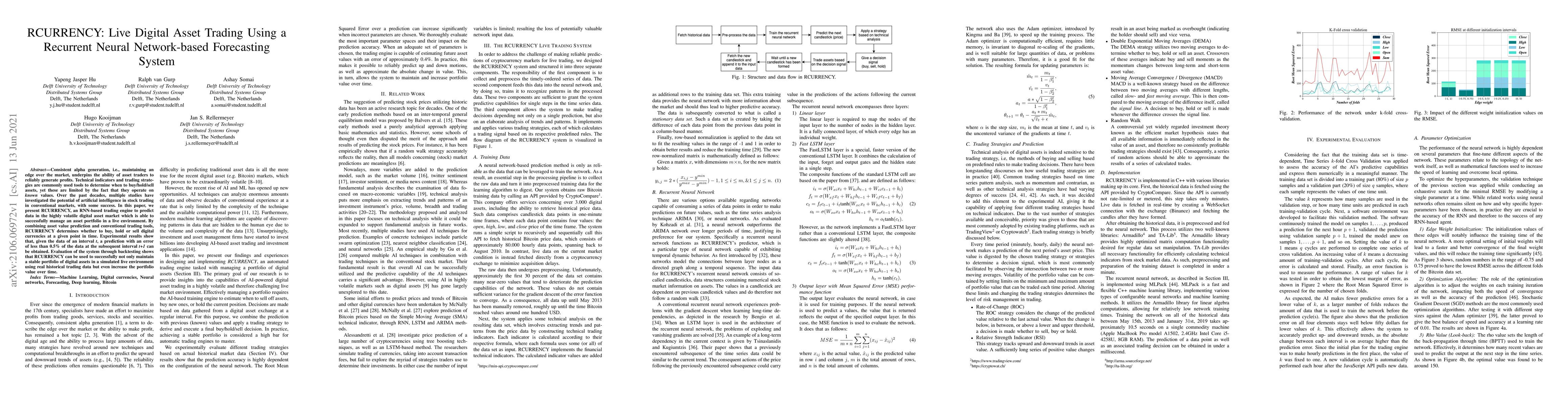

Consistent alpha generation, i.e., maintaining an edge over the market, underpins the ability of asset traders to reliably generate profits. Technical indicators and trading strategies are commonly used tools to determine when to buy/hold/sell assets, yet these are limited by the fact that they operate on known values. Over the past decades, multiple studies have investigated the potential of artificial intelligence in stock trading in conventional markets, with some success. In this paper, we present RCURRENCY, an RNN-based trading engine to predict data in the highly volatile digital asset market which is able to successfully manage an asset portfolio in a live environment. By combining asset value prediction and conventional trading tools, RCURRENCY determines whether to buy, hold or sell digital currencies at a given point in time. Experimental results show that, given the data of an interval $t$, a prediction with an error of less than 0.5\% of the data at the subsequent interval $t+1$ can be obtained. Evaluation of the system through backtesting shows that RCURRENCY can be used to successfully not only maintain a stable portfolio of digital assets in a simulated live environment using real historical trading data but even increase the portfolio value over time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)