Summary

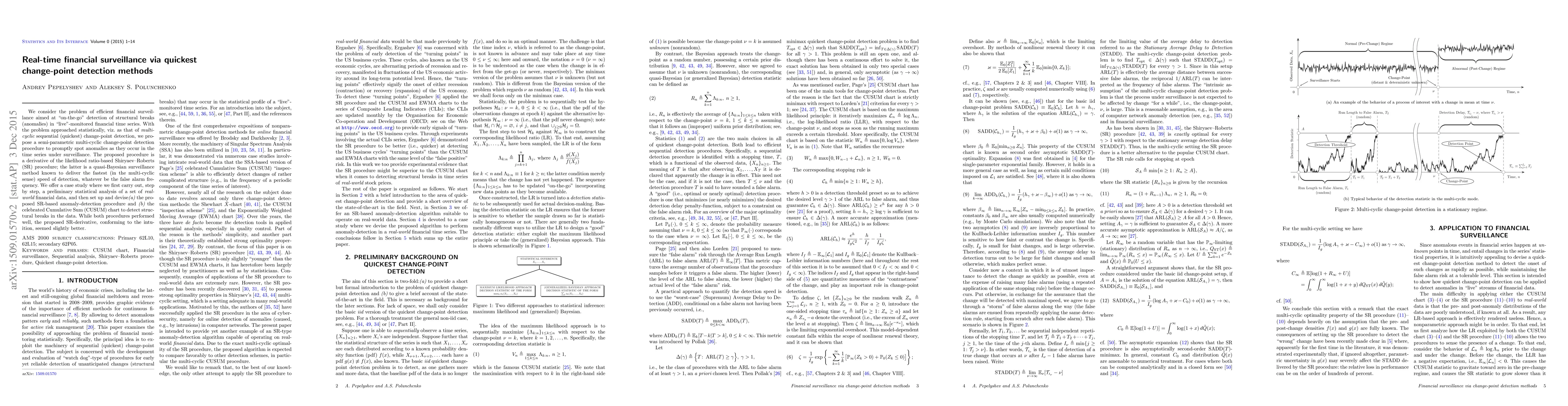

We consider the problem of efficient financial surveillance aimed at "on-the-go" detection of structural breaks (anomalies) in "live"-monitored financial time series. With the problem approached statistically, viz. as that of multi-cyclic sequential (quickest) change-point detection, we propose a semi-parametric multi-cyclic change-point detection procedure to promptly spot anomalies as they occur in the time series under surveillance. The proposed procedure is a derivative of the likelihood ratio-based Shiryaev-Roberts (SR) procedure; the latter is a quasi-Bayesian surveillance method known to deliver the fastest (in the multi-cyclic sense) speed of detection, whatever be the false alarm frequency. We offer a case study where we first carry out, step by step, statistical analysis of a set of real-world financial data, and then set up and devise (a) the proposed SR-based anomaly-detection procedure and (b) the celebrated Cumulative Sum (CUSUM) chart to detect structural breaks in the data. While both procedures performed well, the proposed SR-derivative, conforming to the intuition, seemed slightly better.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUltimate limits for quickest quantum change-point detection

Christoph Hirche, John Calsamiglia, Marco Fanizza

Real-time Fuel Leakage Detection via Online Change Point Detection

Jeffrey Chan, Xiaodong Li, Yiliao Song et al.

Robust Score-Based Quickest Change Detection

Vahid Tarokh, Jie Ding, Sean Moushegian et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)