Summary

Bitcoin is the first digital decentralized cryptocurrency that has shown a significant increase in market capitalization in recent years. The objective of this paper is to determine the predictable price direction of Bitcoin in USD by machine learning techniques and sentiment analysis. Twitter and Reddit have attracted a great deal of attention from researchers to study public sentiment. We have applied sentiment analysis and supervised machine learning principles to the extracted tweets from Twitter and Reddit posts, and we analyze the correlation between bitcoin price movements and sentiments in tweets. We explored several algorithms of machine learning using supervised learning to develop a prediction model and provide informative analysis of future market prices. Due to the difficulty of evaluating the exact nature of a Time Series(ARIMA) model, it is often very difficult to produce appropriate forecasts. Then we continue to implement Recurrent Neural Networks (RNN) with long short-term memory cells (LSTM). Thus, we analyzed the time series model prediction of bitcoin prices with greater efficiency using long short-term memory (LSTM) techniques and compared the predictability of bitcoin price and sentiment analysis of bitcoin tweets to the standard method (ARIMA). The RMSE (Root-mean-square error) of LSTM are 198.448 (single feature) and 197.515 (multi-feature) whereas the ARIMA model RMSE is 209.263 which shows that LSTM with multi feature shows the more accurate result.

AI Key Findings

Generated Sep 07, 2025

Methodology

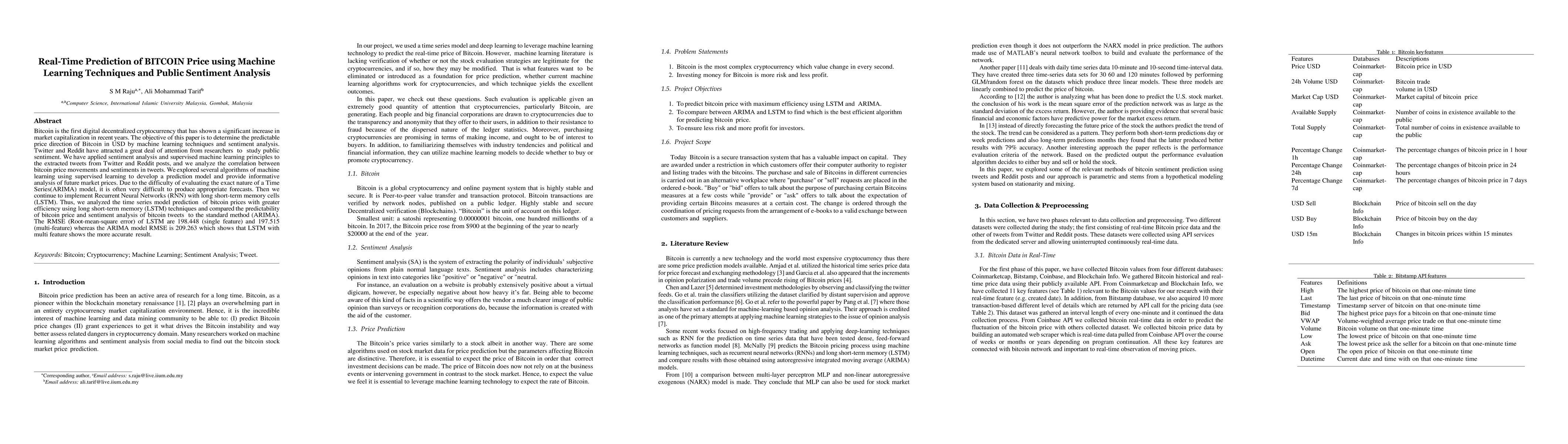

The research employs LSTM (Long Short-Term Memory) networks and ARIMA (Autoregressive Integrated Moving Average) models to predict Bitcoin prices using supervised machine learning and sentiment analysis from Twitter and Reddit posts. LSTM addresses the vanishing gradient problem in RNNs, enabling learning over long periods, while ARIMA decomposes historical data into autoregressive, integrated, and moving average components for forecasting.

Key Results

- LSTM with multi-feature outperformed ARIMA with an RMSE of 197.515 compared to ARIMA's 209.263, indicating better predictability for Bitcoin prices.

- LSTM models showed lower loss and were more effective in recognizing long-term dependencies in Bitcoin price fluctuations than ARIMA.

- The study found that machine learning models, specifically LSTM, require more time to compile due to complex calculations compared to traditional models like ARIMA.

Significance

This research is significant as it contributes to the growing body of work on predicting cryptocurrency prices using machine learning techniques, potentially aiding investors and traders in making informed decisions.

Technical Contribution

The paper presents an advanced LSTM-based approach for Bitcoin price prediction, demonstrating its superiority over traditional ARIMA models in handling high-fluctuation time series data.

Novelty

This work distinguishes itself by integrating public sentiment analysis from social media with LSTM networks for improved Bitcoin price prediction, offering a more comprehensive approach compared to existing research that primarily focuses on technical indicators or simpler machine learning models.

Limitations

- The study is limited to Twitter and Reddit data for sentiment analysis, which may not represent the full spectrum of public opinion on Bitcoin.

- The model's performance is restricted to historical data, and its predictability for real-time, streaming Bitcoin price data is not explored.

Future Work

- Expanding the sentiment analysis to include data from other social media platforms like Facebook and LinkedIn.

- Investigating the model's performance on real-time, streaming Bitcoin price data to enhance its practical applicability.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCryptocurrency Price Prediction using Twitter Sentiment Analysis

Haritha GB, Sahana N. B

Using Sentiment and Technical Analysis to Predict Bitcoin with Machine Learning

Arthur Emanuel de Oliveira Carosia

| Title | Authors | Year | Actions |

|---|

Comments (0)