Summary

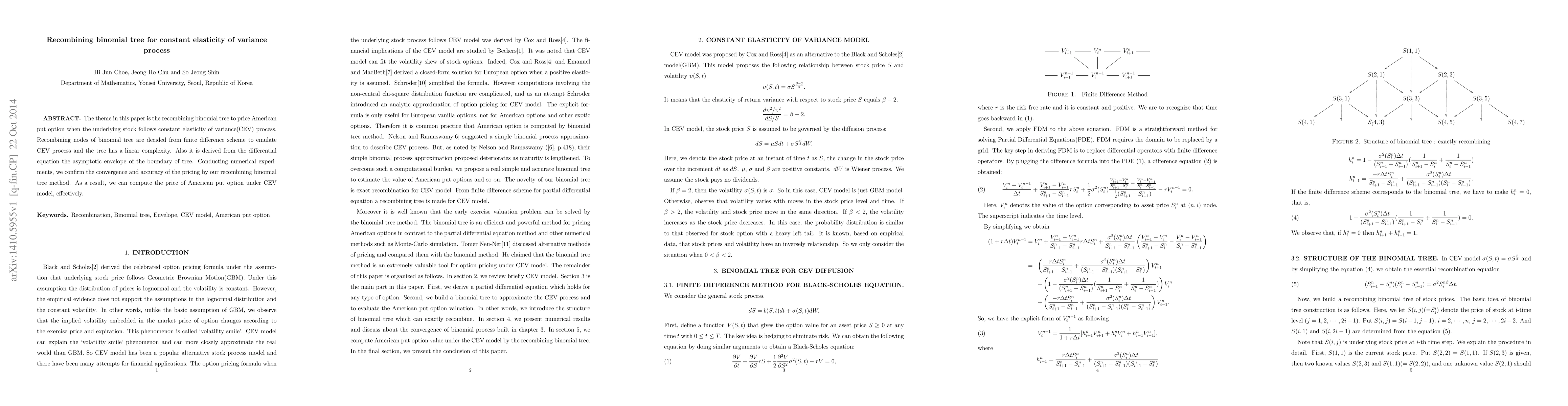

The theme in this paper is the recombining binomial tree to price American put option when the underlying stock follows constant elasticity of variance(CEV) process. Recombining nodes of binomial tree are decided from finite difference scheme to emulate CEV process and the tree has a linear complexity. Also it is derived from the differential equation the asymptotic envelope of the boundary of tree. Conducting numerical experiments, we confirm the convergence and accuracy of the pricing by our recombining binomial tree method. As a result, we can compute the price of American put option under CEV model, effectively.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)